Companies mentioned

· Action (ACT)

· Atlanta Poland (ATP)

· Bowim (BOW)

· Dekpol (DEK)

· Czerwona Torebka (CZT)

· Feerum (FEE)

· Forte (FTE)

· Helio (HEL)

· Harper Hygienics (HRP)

· Izostal (IZS)

· Monnari Trade (MON)

· Mercator Medical (MRC)

· Mostostal Zabrze (MSZ)

· Maxcom (MXC)

· NTT System (NTT)

· PA Nova (NVA)

· Sanwil (SNW)

· Stalprofil (STF)

· Vindexus (VIN)

· Grupa Azoty Zaklady (ZAP)

Benjamin Graham famously suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. The prevalence of net-nets serves as a barometer for market valuation. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive.

Below is this week’s net-net screen from Stockopedia. Note though that today’s net-nets are not the same as Graham’s net-nets. We view many of these as un-investable being loss-making biopharma’s etc. But even though we would not invest in a large part of today’s crop we think it could be interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. So, each week, we plan to hold “Graham’s Geiger counter” over our markets.

Action – 3Q24, EGM requested to amend share buyback program & Buyback

ACT │ New Report, EGM - Buybacks│ P/TB 0.70 │ Electronics Distribution│ URL / URL / URL

During 3Q24, sales amounted to 627 mpln, a slight decrease compared to 641 mpln in Q3 2023. Gross profit from sales reached 50.3 mpln, reflecting a decline from 54.45 mpln in the prior year. Operating profit stood at 7.3 mpln, down from 10.0 mpln in Q3 2023. The group continues to focus on operational efficiency and cost management amid challenging market conditions. Risks related to tax disputes and regulatory matters remain, but management is confident these will not significantly impact the group's operations. Strategic priorities include diversifying product offerings and strengthening market presence.

The Management Board of ACT has received a formal motion from shareholder Lemuria Partners Sicav PLC, holding 8% of the company’s share capital, to convene an EGM. The proposed agenda includes resolutions to amend previous decisions related to the company’s Buyback Program. Specifically, the amendments seek to increase the number of shares eligible for buyback to 3m and allocate 80 mpln for the program.

Between November 28 and December 4, 2024, ACT conducted a series of transactions under its share buyback program authorized by the Annual General Meeting on June 19, 2024. During this period, ACT acquired a total of 9k shares (0.05% of NOSH) at an average price of 17.89 pln per share, amounting to a total expenditure of 161k pln. ACT now holds a total of 1.2m (7.25%) shares under the buyback program.

Atlanta Poland – 1Q24/25

ATP │ New Report│ P/TB 1.00 │ Snacks & Nutrition│ URL

In Q1 of FY24/25, ATP reported sales of 109 mpln (108.7 mpln. The gross profit from sales decreased to 19.2 mpln (21.2 mpln), corresponding to a gross margin of 17.6% (19.5%). The net profit amounted to 3.2 mpln (6.6 mpln). Operational cash flow during the quarter was negative at -3 mpln, primarily due to increased inventory levels and higher receivables. The company emphasized its dual focus on wholesale and retail operations, with wholesale sales generating 64.2 mpln and retail contributing 44.0 mpln in revenue. Export sales improved slightly to 30.0 mpln, driven by increased demand for processed nuts. Management remains cautious about the economic environment but is committed to optimizing working capital and sustaining profitability.

Bowim – DM Bos raised the valuation to 5.5 pln

BOW │ Analysis│ P/TB 0.25 │ Steel Processing & Trade│ URL

BOW reported improved Q3 2024 results, surpassing earlier forecasts due to higher-than-expected steel sales volumes. BOW is increasing its market share despite a declining steel market, driven by low demand and competitive pricing pressures. However, operational and net losses persisted, reflecting ongoing margin challenges. BOW anticipates a continuation of these trends through Q4 2024, with forecasted revenue of 439 mpln (-6% QoQ) and EBITDA of 0.1 mpln, alongside operational and net losses of -2.2 mpln and -3.6 million, respectively.

For the full year 2024, BOW revised its forecasts upwards following stronger Q3 performance, now projecting revenue of 1,815 mpln, EBITDA of 7.3 mpln, and a net loss of -17.4 mpln. Market recovery is expected in 2025, supported by increased investments in infrastructure and renewable energy, such as wind farms. BOW forecasts revenue growth to 1,887 mpln (+4% YoY) and a return to profitability, with EBITDA of 39.4 mpln and net profit of 11.6 mpln.

Despite the current challenges, BOW’s stronger market position and anticipated economic recovery underpin its growth potential. The company's 12-month price target has been revised to 5.5 pln per share (previously PLN 5.1), reflecting improved long-term outlooks and updated comparative valuations.

Czerwona Torebka – 3Q24

CZT │ New Report│ P/TB 0.36 │ Real Estate│ URL

CZT reported a net loss of 9.3 mpln for 3Q24, worsening from a 1.6 mpln loss in 3Q23. Revenues for the quarter declined to 1.7 mpln compared to 3.9 mpln in the prior year, reflecting weaker sales from inventory properties and reduced rental income. Operating losses amounted to 9.8 mpln, driven by higher costs and lower margins, particularly in the real estate segment. For the nine months ending September 30, 2024, the company posted a net loss of 12.1 mpln, deepening from 4.8 mpln in the same period of 2023.

The Group managed to generate 41.5 mpln in positive cash flow from investing activities, largely due to the sale of investment properties. Management emphasized the importance of its real estate portfolio, valued at approximately 153 mpln, as a source of liquidity through planned sales. While facing persistent challenges, including legal disputes and restructuring needs, the Group continues to explore measures to stabilize its financial performance and improve its cash flow management.

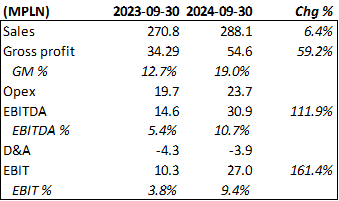

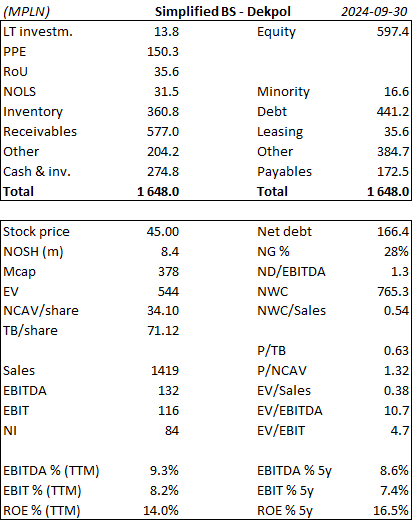

Dekpol – Solid performance amid challenges and focused growth outlook & successful bond issuance

DEK │ New Report│ P/TB 0.67 │ Construction│ URL / URL

DEK reported consolidated sales of 975.4 mpln for the first nine months of 2024 (1,065.7 mpln). Despite the revenue decline, the group achieved a net profit of 60.4 mpln (58.6 mpln last year). YTD, the general contracting segment generated 725.7 mpln, development activities 120 mpln, while the production of construction machinery components 91.3 mpln. Notably, the development segment showed improved margins, indicating operational efficiencies in this area. Key achievements in Q3 2024 included the early completion of the Forensic Laboratory project in Poznań, finalized six months ahead of schedule, and signing pre-contract agreements for land acquisitions in Kamesznica and Katowice, signaling the group’s expansion into new geographic areas.

Looking ahead, DEK is optimistic about sustaining stable performance but remains cautious about macroeconomic challenges such as fluctuating interest rates and inflationary pressures (currently at 4.6%). The management aims to prioritize profitability while strategically expanding its operations and maintaining financial prudence. DEK also announced the successful issuance of 102,569 series N bearer bonds, each with a nominal value of PLN 1,000, totaling 103 mpln.

Feerum - Navigating Challenges and Preparing for Growth

FEE │ New Report│ P/TB 0.83 │ Agriculture Machines│ URL

FEE reported revenues of 52.4 mpln (49.0 mpln) for the first three quarters of 2024, primarily driven by domestic market sales. The group achieved a gross profit of 8.2 mpln (9.0 mpln), while EBITDA totaled 6.3 mpln (8.3 mpln). Despite challenging market conditions, FEE recorded a net profit of 0.4 mpln (0.3 mpln). 3Q24, however, seemed quite bright.

The agricultural and food processing sectors faced significant disruptions due to geopolitical tensions, particularly the influx of Ukrainian grain, which impacted local market prices and created uncertainty. This, coupled with delays in EU funding, led to challenges in market absorption and investment activities. To mitigate these effects, FEE adjusted its pricing strategies and sold off corn stocks at revised valuations, ensuring steady financial performance despite rising costs for materials and services driven by inflation.

Amid these challenges, FEE diversified its operations by expanding into the consumer market with its "Madani" brand, offering bicycles and related accessories. Additionally, the group strengthened its international presence by acquiring a 50% stake in Feerum Egypt Company for Silos and Storage, targeting Egypt's growing agricultural infrastructure sector and broader markets in the Middle East and North Africa.

Looking ahead, FEE anticipates growth opportunities in both domestic and international markets. Government incentives and EU subsidies are expected to fuel demand for agricultural infrastructure, with a contracted order portfolio of 70.8 mpln for 2024/2025. The group remains well-positioned to secure new projects, leveraging its comprehensive product offerings and operational expertise.

Forte - Appointment of supervisory board member and decisions from EGM

FTE │ BOD change │ P/TB 0.69 │ Furniture│ URL / URL / URL

The EGM, which was held on December 4, 2024, appointed Ms. Ewa Mazurkiewicz as a Member of the Supervisory Board for the 2022-2026 term. Ms. Mazurkiewicz does not hold any positions in competitive companies or entities, nor is she listed in the Register of Insolvent Debtors. The meeting also selected members of the Vote Counting Committee, with Ms. Monika Chechłacz and Mr. Hubert Kaczmarski appointed to this role. These decisions were unanimously supported by the shareholders present, representing 77.8% of the company’s share capital.

Helio - Record Sales Amid Profitability Challenges and Strategic Investments

HEL │ New Revenue│ P/TB 0.61 │ Snacks & Nutrition│ URL

Sales for 1Q24/25 were 86 mpln, marking a 2.5% increase compared to the same period last year. However, rising raw material costs and elevated operational expenses affected profitability. EBITDA dropped by 22% year-over-year to 6.3 mpln, while net profit fell sharply from 4.3 mpln to 0.8 mpln, primarily due to unfavorable currency exchange fluctuations. Export sales, primarily conducted in EUR, accounted for 4% of total revenue, down from 8% in the same period last year.

In preparation for the peak holiday sales season, the company significantly increased its inventory levels, leading to a corresponding rise in short-term liabilities. Helio also undertook major investments in expanding and modernizing its production and storage facilities, financed through long-term credit lines and internal resources. Concurrently, the company continued strategic marketing efforts to promote its products as part of a healthy diet, maintaining stable sales volumes despite market challenges.

Operating cash flow for the quarter was -14.6 mpln, driven by increased inventory purchases. Investment activities resulted in a cash outflow of -5.9 mpln, while financing activities generated 22.9 mpln, primarily from new credit facilities.

Looking ahead, HEL expects stronger performance in the coming quarters, driven by increased sales during the holiday season. Investments in capacity and technological upgrades are set to continue, aligning with its long-term growth strategy.

Harper Hygienics - Revenue decline amid rising costs, strategic focus on efficiency

HRP │ New Report│ P/TB 0.52 │ Consumer Defensives│ URL

HRP reported revenues of 170.6 mpln for the first three quarters of 2024 (204.3 mpln). The company achieved a gross profit of 50.4 mpln (57.3 mpln), as rising costs of raw materials and inflationary pressures impacted profitability. Net profit stood at 1.0 mpln (9.6 mpln).

The company operates across four main product segments: cotton, nonwoven fabrics, goods, and others.

Cotton-based products, including cotton pads and buds, contributed the largest share of revenues at 92.8 mpln, followed by nonwoven fabrics at 58.0 pln. Both segments faced declines in sales compared to 2023. Geographically, domestic sales accounted for 88.4 mpln, with exports to Italy, Ukraine, and other markets contributing 82.2 mpln, down from 104.9 mpln last year.

Looking ahead, the company anticipates a challenging environment due to ongoing inflation and competitive pressures in its key markets. However, with a focus on operational efficiencies, innovative product offerings, and strategic financial management, HRP aims to stabilize performance and drive growth in the coming quarters.

Izostal - Secures major gas network reconstruction projects

IZS │ Order│ P/TB 0.35 │ Steel Processing & Trade│ URL / URL

IZS announced its participation in two significant agreements as part of consortium projects with STF Infrastruktura Sp. z o.o. (Consortium Leader) and Gascontrol Polska Sp. z o.o. (Participant 1), in collaboration with Polska Spółka Gazownictwa Sp. z o.o. The first agreement involves the reconstruction of a high-pressure gas network within the Łódź bypass. The project, valued at 135 mpln gross, includes the construction of a DN 500 MOP 5.5 MPa gas pipeline extending approximately 26 km, along with accompanying infrastructure. IZS’s role in the consortium will focus on supplying materials, and the project is expected to be completed by May 31, 2029.

The second agreement entails the construction of a gas pipeline connecting Kalisz to Sieradz. This project, valued at 218 mpln gross, involves the construction of two gas pipelines, DN 500 MOP 6.3 MPa (62.10 km) and DN 500 MOP 8.4 MPa (0.14 km), as well as supporting infrastructure such as reduction stations, blocking systems, and a measurement station. IZS will again be responsible for supplying materials. The project completion is scheduled within 25 months from the Ordering Party's confirmation of the Co-financing Agreement.

These agreements, recognized as significant by the company due to their high values, are expected to considerably enhance IZS's revenue streams over the project periods.

Monnari Trade - Buybacks

MON │ Buybacks│ P/TB 0.35 │ Apparel Retal│ URL / URL / URL

MON announced the acquisition of treasury shares as part of its ongoing share buyback program. The company purchased a total of 4.4k shares, representing approximately 0.013% of its share capital. Following these transactions, MON now holds 5.2m treasury shares, constituting 17% of its share capital and entitling to 15% of votes at the General Meeting.

Mercator Medical - Revenue growth amid operational challenges and strategic investments

MRC │ New Report│ P/TB 0.63 │ Medical Devices│ URL

MRC reported consolidated revenue of 393.3 mpln for the first nine months of 2024, reflecting an 11.7% increase compared to the same period last year. Despite this growth, the group faced operational challenges, resulting in an operating result of -19.3 mpln, however, a significant improvement from -60.6 mpln in the prior year. The group recorded a net income of -16.4 mpln, down from -29.5 mpln in Q3 2023, as gross margins were impacted by rising production costs and competitive market conditions.

The group’s primary focus remains the manufacturing and distribution of medical gloves, with strong market presence in Europe and emerging markets. Persistent external challenges, including unfavorable currency fluctuations and increased raw material costs, weighed on profitability. Nonetheless, Mercator Medical maintained robust inventory levels to ensure supply chain stability and meet customer demands across its key markets.

Looking ahead, the group expects macroeconomic challenges, including inflation and global competition, to persist. However, MRC remains focused on improving operational efficiency, investing in innovation, and expanding its market reach. Management is optimistic about stabilizing performance and leveraging strategic investments in the coming quarters.

Mostostal Zabrze - KMW Investment acquires shares

MSZ │ Insider Buy│ P/TB 1.26 │ Construction│ URL

KMW Investment, closely associated with Krzysztof Jędrzejewski, Chairman of the Supervisory Board of MSZ, reported the acquisition of shares on November 27, 28, and 29, 2024. On November 27, KMW Investment purchased 39.6k shares at an average price of 4.66 pln per share. The following day, the company acquired an additional 41.6k shares at an average price of 4.77 pln. On November 29, the acquisition continued with 65.2k shares bought at an average price of 4.87 pln. In total, KMW Investment acquired 146.4k shares over the three days.

Maxcom – 3Q24

MXC │ New Report│ P/TB 0.39 │ Electronic Products│ URL

MXC reported revenues of 79.8 mpln for the first nine months of 2024 (102.9 mpln). Operating profit decreased to 1.6 mpln (4.6 mpln), while the group recorded a net income of -0.4 mpln (1.6 mpln). The decline in profitability was attributed to higher operating expenses and reduced sales volumes. The core consumer electronics segment contributed 74.5 mpln in sales, with products such as phones, navigation devices, and small household electronics leading the revenue. Other products and services, including photovoltaics and rental operations, generated 5.3 mpln.

Despite the revenue decline, the group saw improved cash flow from operating activities, which turned positive at 6.4 mpln (-1.0 mpln), aided by better working capital management. Looking ahead, MXC anticipates a stronger performance in Q4, driven by seasonal demand for its consumer electronics. The management is focused on maintaining cost control, improving efficiency, and expanding into renewable energy and other adjacent markets to counterbalance the challenges in its core business segments.

NTT System - Revenue decline offset by profit growth and operational efficiency

NTT │ New Report│ P/TB 0.58 │ Electronics Distribution│ URL

NTT reported revenue of 1,034 mpln for the first nine months of 2024, a slight decrease from 1,136 mpln in the same period last year. Despite the revenue decline, gross profit increased to 74.0 mpln compared to 62.5 mpln in 2023, and net profit rose to 17.1 mpln, up from 15.0 mpln.

Looking ahead, NTT is optimistic about the remainder of 2024 and beyond, aiming to sustain profitability and revenue growth through disciplined cost management and strategic investments. The company plans to expand its product offerings and leverage opportunities in the IT and electronics sectors, while continued investments in technology and logistics are expected to further strengthen its market position.

PA Nova - Stable performance amid revenue decline and strategic investments

NVA │ New Report│ P/TB 0.31 │ Construciton│ URL

NVA reported revenues of 208.5 mpln for the first nine months of 2024, a decrease from 284.2 mpln during the same period last year. The group achieved a net profit of 17.7 mpln (30.8 mpln), and Operating profit 37.8 mpln (52.4 mpln). The results were influenced by increased operational costs and reduced sales volumes in key segments. The group’s revenue streams are largely driven by its construction and development projects, including general contracting and rental income from investment properties.

Looking ahead, NVA remains optimistic about its growth prospects. With a robust pipeline of construction projects and demand for its services, the group aims to maintain stable financial performance. Strategic focus on operational efficiency and cost optimization is expected to drive profitability and support long-term growth.

Sanwil – 3Q24

SNW │ New Report│ P/TB 0.35 │ Coated Fabrics│ URL

SNW’s consolidated revenue for Q3 2024 reached 6.15 mpln, contributing to a cumulative revenue of 21.1 mpln for the first nine months, reflecting a slight decline of 2% year-on-year. Domestic sales fell by 13.5%, influenced by heightened competition and reduced demand, whereas export revenues increased by 32%, driven by recovery in key markets such as Ukraine and expansion into Western Europe.

The company maintained a positive operational performance with a net profit of 4.4 mpln for the nine months, down from 6.0 mpln in the previous year. The reduced profitability stems from higher operational expenses and the necessity to lower domestic market prices to remain competitive.

The coated products segment, led by Sanwil Polska, remains pivotal, accounting for the majority of sales across diverse industries, including furniture, footwear, and medical supplies. Efforts are underway to diversify further and enhance technological capabilities to adapt to evolving market trends and client demands.

Looking ahead, Sanwil plans to focus on expanding its export footprint, especially in high-potential European markets. Concurrently, initiatives to optimize operational costs, strengthen marketing, and modernize production facilities are prioritized to sustain growth amid challenging macroeconomic conditions and rising production costs.

Stalprofil - Conclusion of two significant agreements

STF │ New Order│ P/TB 0.30 │ Steel Processing & Trade│ URL / URL

STF announced the conclusion of two significant agreements with Polska Spółka Gazownictwa Sp. z o.o. The first agreement pertains to the reconstruction of the gas network along the Łódź bypass, involving a high-pressure gas pipeline of 26 km (DN 500, MOP 5.5 MPa) and associated infrastructure, valued at 135 mpln gross (109.47 mpln net). The project, led by STF Infrastruktura Sp. z o.o. with participation from Izostal SA and Gascontrol Polska Sp. z o.o., is scheduled for completion by May 31, 2029.

The second agreement concerns the construction of the Kalisz-Sieradz gas pipeline, comprising 62.10 km of DN 500, MOP 6.3 MPa pipeline, and 0.14 km of DN 500, MOP 8.4 MPa pipeline, along with reduction and measurement stations and related infrastructure. The project is valued at 218 mpln gross (177 mpln net) and is expected to be completed within 25 months following the Ordering Party's notification of co-financing agreement conclusion.

Both projects are managed by subsidiaries of STF, STF Infrastruktura Sp. z o.o., and Izostal SA. They are projected to significantly boost revenues for the STF within the gas transmission network infrastructure segment, reflecting the group's strategic focus on expanding its presence in this sector.

Vindexus - Confirms strong financial indicators for bond series compliance

VIN │ Financial Update│ P/TB 0.40 │ Financial│ URL

The Management Board of VIN reported the financial indicators for its bond series O2, P2, and T2 as of September 30, 2024. The Net Financial Debt to Equity ratio stood at 0.003, the Financial Ratio at 0.005, and the Collateral Ratio at 0.14. All these values remain well below the maximum thresholds of 1.20, 1.85, and 0.70, respectively, as defined in the bond issuance terms.

Pulawy – Financial agreements amendments

ZAP │ Refinancing│ P/TB 0.31 │ Specialty Chemicals│ URL / URL / URL

ZAP announced the signing of an annex to its financing agreements with 13 financial institutions. This annex extends the availability of financing limits and prevents the institutions from cancelling or reducing these limits until March 31, 2025, subject to periodic extensions confirmed by the lenders. The annex supports the continuation of restructuring efforts and the development of a long-term restructuring plan for the ZAP while maintaining liquidity and financial stability.

An EGM was held on December 5, 2024, where resolutions were adopted without objections. The EGM focused on significant operational and governance matters and highlighted the importance of stakeholder alignment in strategic decision-making processes. The financial annex and the outcomes of the EGM demonstrate ZAP’s ongoing efforts to stabilize operations, maintain investor confidence, and align with broader group restructuring plans.

The writer may own shares of the companies mentioned. This communication is for informational purposes only.