Companies mentioned

· Action SA (ACT) – Sales figures, EGM & Buybacks

· Bowim (BOW) & Stalprofil (STF) – Mentioned on X

· Compremum (CPR) – Nationale-Nederlanden Decreases its Stakes

· Dębica (DBC) - Loan Agreements with Goodyear SA

· Kompap (KMP) – Insider Purchase

· KPD (KPD) - Extension of Bank Guarantee and Update on Wood Purchase Agreements

· Libet S.A (LBT) - PKO BP Bankowy Reduces Stake Below 5%

· Moj (MOJ) - Receives Significant Orders from FASING SA

· Monnari Trade (MON) – Further Buybacks

· PA Nova (NVA) - Signs Construction Contract with Kaufland Polska

· Selena FM (SEL) - Supervisory Board Member Resigns

· Grupa Azoty Puławy (ZAP) - Plans Extraordinary General Meeting for Key Resolutions

· ZUE (ZUE) – New Analysis

· Piotr Shared Some Technical Analysis of Several Deep Value Cases

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

Action SA (ACT) – Sales figures, EGM & Buybacks

P/TB 0.97 │ IT Distribution│ URL

Action SA reported preliminary revenue of PLN 273 million for December 2024, reflecting an increase of approximately 7.5% compared to the same period in 2023. The gross margin remained consistently high at around 7.6%.

The company also announced that between January 2 and January 8, 2025, it repurchased a total of 13,092 treasury shares with a total value of approximately PLN 272,000. These shares were acquired on the Warsaw Stock Exchange through Ipopema Securities SA. Following these transactions, Action SA holds a total of 1,247,391 treasury shares, representing 7.54% of the company's share capital.

At an Extraordinary General Meeting held on January 9, 2025, shareholders approved an increase in the share buyback program to a maximum of 3 million shares and raised the total budget for the program to PLN 80 million. Amendments to the company's Articles of Association were also approved, including changes to the terms of independent board members' mandates and the criteria for the selection of auditors. Furthermore, the reserved capital was increased to PLN 80 million to finance the share buyback program.

The Management Board has decided to commence the implementation of the amended share buyback program, effective from June 20, 2024, to no later than September 30, 2027, or until the allocated funds are exhausted. Shares may be repurchased for either cancellation and share capital reduction or resale purposes. The share purchase price cannot be lower than the nominal value and must not exceed PLN 35.

For purchases on the Warsaw Stock Exchange, daily purchase volumes must not exceed 25% of the average daily trading volume over the preceding 20 trading days. If shares are acquired outside the regulated market, separate terms will be established.

Bowim (BOW) & Stalprofil (STF) – Mentioned on X

P/TB 0.25 / 0.28 │ Steel Processing│ URL

Przemyslaw Gatowski shared his thoughts on Bowim and Stalprofil on X.

Compremum (CPR) – Nationale-Nederlanden Decreases its Stakes

P/TB 0.22 │ Construction│ URL

Nationale-Nederlanden Powszechne Towarzystwo Emerytalne S.A. has announced that its total shareholding in Compremum S.A. has decreased to below 15% of the voting rights at the company's General Meeting. This reduction occurred following the sale of shares on the Warsaw Stock Exchange on December 23, 2024.

After the transaction, the funds managed by Nationale-Nederlanden, including its open and voluntary pension funds (OFE and DFE series), collectively hold 7,082,052 shares, representing 14.53% of the voting rights and 15.80% of the share capital, compared to the previous 7,607,706 shares, which represented 15.61% of the voting rights and 16.97% of the share capital.

Dębica (DBC) - Loan Agreements with Goodyear SA

P/TB 0.85 │ Tires│ URL

Firma Oponiarska Dębica SA (Dębica) has signed two loan agreements with Goodyear SA, a Luxembourg-based company and the majority shareholder of Dębica, owning 87.251% of shares. Under these agreements, Dębica will provide Goodyear with loans totaling PLN 200 million.

The first loan, valued at PLN 100 million, will be disbursed on December 19, 2024, with repayment due by December 19, 2025. The second loan, also PLN 100 million, will be disbursed on the same date but is scheduled for repayment by February 3, 2025. Both loans carry an annual interest rate of 6.04%, calculated as WIBOR1Y plus a 0.45% margin.

The loans are secured by a guarantee from The Goodyear Tire & Rubber Company, Dębica's ultimate controlling entity based in Akron, Ohio. Including these new agreements, the total loan exposure to Goodyear will amount to PLN 690 million as of December 19, 2024, excluding interest. The agreements were classified as confidential due to their size and the involvement of the parent company.

Kompap (KMP) – Insider Purchase

P/TB 1.43 │ Printing│ URL

Waldemar Libka bought another 750 shares on the 30th of December. Since mid-2012 he has made 182 buy transactions, for a total of 5.6 mpln, with an average 1y return of 12%.

KPD (KPD) - Extension of Bank Guarantee and Update on Wood Purchase Agreements

KPPD-Szczecinek SA has signed an annex with Pekao SA bank to extend the validity of a bank guarantee ensuring payment for wood raw material purchased from the State Forests. The extended validity now lasts until March 31, 2026, while the guarantee amount remains unchanged at PLN 15 million. No other terms from the original agreement have been modified compared to those disclosed in the 2023 annual report and announcement No. 9/2024.

Additionally, KPPD has ongoing wood purchase agreements with multiple Regional Directorates of State Forests (RDLP). These include contracts with RDLP Szczecinek for PLN 39.7 million net, RDLP Szczecin for PLN 10.5 million net, and RDLP Piła for PLN 10.4 million net. The agreements regulate the general terms of wood purchases, specifying the division of supplies among various forest districts under each RDLP.

Libet S.A (LBT) - PKO BP Bankowy Reduces Stake Below 5%

P/TB 0.93 │ Building Products│ URL

PKO BP Bankowy Open Pension Fund (PKO BP OFE) and PKO Voluntary Pension Fund (PKO DFE), represented by PKO BP Bankowy Powszechne Towarzystwo Emerytalne S.A., disclosed a reduction in their voting rights in Libet S.A. below the 5% threshold. On December 27, 2024, the funds completed the sale of 1 million shares, decreasing their combined shareholding from 6.36% to 4.36% of Libet's share capital and voting rights.

Prior to the transaction, PKO BP OFE held 3.16 million shares (6.32% voting rights), and PKO DFE owned 21,541 shares (0.04% voting rights). Following the sale, PKO BP OFE's holding was reduced to 2.16 million shares (4.32%), while PKO DFE retained 21,541 shares. Collectively, they now control 2.18 million shares, representing a 4.36% stake.

Moj (MOJ) - Receives Significant Orders from FASING SA

P/TB 0.34 │ Mining Equipment│ URL

The Management Board of MOJ SA in Katowice announced receiving orders from FASING SA valued at PLN 4,449,758.70 gross on January 7, 2025. The orders pertain to the supply of forgings, scrapers, locks, links, half-links, and related services. Including these new transactions, the total value of orders received from FASING SA since November 8, 2024, amounts to PLN 9,499,874.25 gross.

Monnari Trade (MON) – Further Buybacks

P/TB 0.43 │ Apparel│ URL

Monnari Trade S.A. continued its share buyback program, acquiring shares on multiple dates in January 2025. On January 9, 2025, the company purchased 2,796 shares at an average price of PLN 4.94. Earlier, on January 8 and 7, the company acquired 2,850 and 3,034 shares at average prices of PLN 4.90 and PLN 4.98, respectively. These purchases were executed through mBank's brokerage house under the terms of an agreement signed on November 20, 2023. Following these transactions, Monnari Trade S.A. holds a total of 5,228,774 own shares, representing 17.11% of its share capital and entitling to 14.88% of the voting rights at the General Meeting.

PA Nova (NVA) - Signs Construction Contract with Kaufland Polska

P/TB 0.31 │ Construction│ URL

PA NOVA S.A. announced the signing of a construction contract with Kaufland Polska Markety Sp. z o.o. Sp. j. on January 7, 2025. Under the agreement, PA NOVA will construct a shopping center along with a parking lot and accompanying infrastructure. The project is scheduled for completion by August 28, 2025. The contract's net value represents approximately 7% of the PA NOVA Group's revenue, based on the latest published annual consolidated financial statements.

Selena FM (SEL) - Supervisory Board Member Resigns

P/TB 0.97 │ Construction│ URL

Selena FM S.A. announced that Mr. Mariusz Warych, a member of the Supervisory Board, has resigned from his position effective December 31, 2024. No reasons were provided for the resignation.

Grupa Azoty Puławy (ZAP) - Plans Extraordinary General Meeting for Key Resolutions

P/TB 0.29 │ Chemicals│ URL

Grupa Azoty Zakłady Azotowe "Puławy" S.A. has scheduled an Extraordinary General Meeting (EGM) for January 31, 2025, to address several formal and corporate matters. The proposed agenda includes electing the Chairperson for the meeting, verifying proper convening, and confirming the capacity to adopt resolutions.

The EGM will also vote on approving the meeting's agenda, selecting a vote-counting committee, and making changes to the remuneration policies for both the Supervisory Board and Management Board members. Additional resolutions will involve amendments to the company's remuneration policy and proposed changes in the Supervisory Board's composition, including the potential dismissal and appointment of members.

ZUE (ZUE) – New Analysis

P/TB 1.24 │ Construction│ URL

ZUE Group, a leading player in the construction of railway and urban rail infrastructure, specializes in the design and modernization of tram and railway lines. The company, listed with a share price of PLN 3.40 and a market capitalization of PLN 78.2 million, generates revenue of PLN 38.37 per share and an EPS of PLN 0.23. With 23.03 million shares outstanding and a free float of 23.4%, the majority shareholder remains the company's founder and president, aligning management closely with shareholder interests.

Despite recent financial pressures in the rail infrastructure sector, ZUE has maintained positive operating and free cash flow with a net debt/EBITDA ratio of 0.78x. The company's order backlog stands at approximately PLN 1.4 billion, potentially increasing to PLN 1.8 billion with upcoming tenders. City infrastructure contracts, which offer better margins than railway projects, now contribute over 20% of total orders, signaling a strategic diversification effort during a period of stalled EU funding for railway investments.

Looking ahead, ZUE anticipates further market expansion opportunities in Bulgaria and Romania, where it is actively preparing bids for both city and rail contracts. The CEO's diplomatic ties as an Honorary Consul of Bulgaria in Kraków could support these efforts. Currently trading at a 4.86x EV/EBITDA and a 0.49x book value, the company remains undervalued with potential catalysts including the release of EU railway project funding and contract wins in foreign markets.

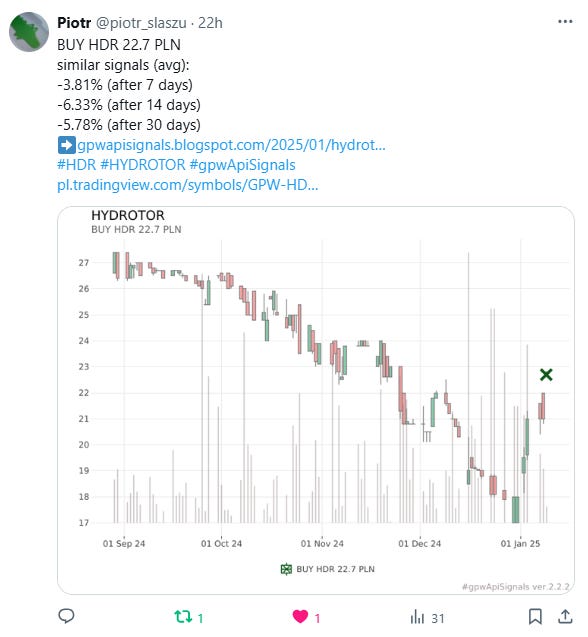

Piotr Shared Some Technical Analysis of Several Deep Value Cases

Discussion│ URL

Piotr shared some technical analysis on several deep value cases on X.

The writer may own shares of the companies mentioned. This communication is for informational purposes only.