Companies mentioned

· Bowim (BOW) – Strong Week & Mentioned on X

· KF Efekt (EFK) - Strong Quarter with Stable Growth and Positive Outlook & Resumed Trading

· Monnari Trade S.A. (MON) – Further Buybacks

· Remak Energomontaz (RMK) – FY2024

· Stalprodukt (STP) – Tender Offer (again)

· Werth-Holz S.A. (WHH) - Announces Annual General Meeting on March 31, 2025

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

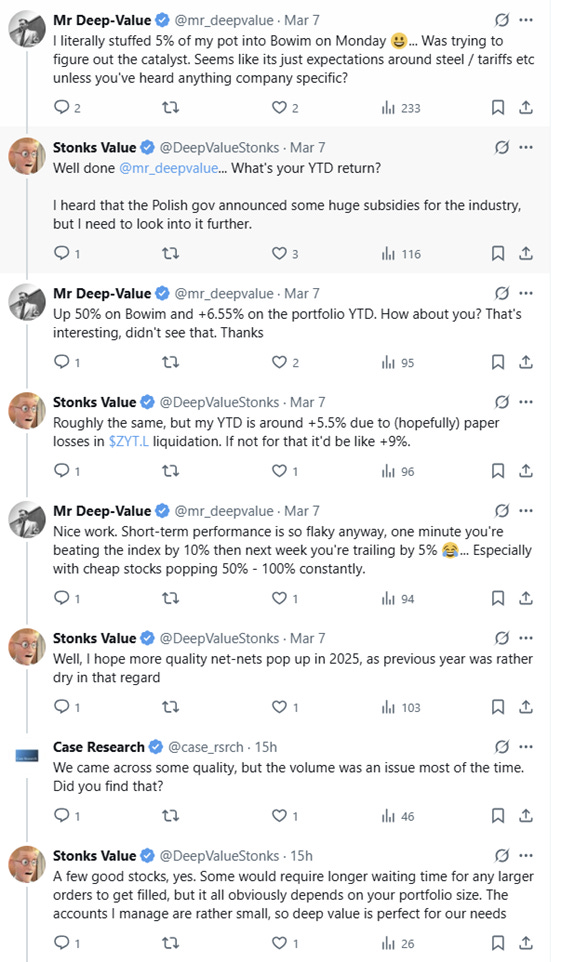

Bowim (BOW) – Strong Week & Mentioned on X

P/TB 0.37 │ URL

Stonks Value and Mr Deep-Value discussed the company on X.

KF Efekt (EFK) - Strong Quarter with Stable Growth and Positive Outlook & Resumed Trading in the Share

P/TB 0.26│ URL

The company reported solid performance in the latest quarter, with revenue growth reflecting strong demand and operational efficiency. Operating profit improved, driven by increased volumes and cost control. Net profit showed a stable increase, and cash flow remained strong, providing a solid foundation for future investments.

Management maintains a positive outlook for the coming quarters, expecting continued growth supported by a strong order book and favorable market conditions. The focus is on profitable expansion, with investments in product development and digitalization aimed at enhancing competitiveness. The company also sees opportunities for acquisitions that could strengthen its position in key markets. Risks going forward include macroeconomic uncertainty, potentially higher financing costs, and volatile raw material prices.

The company acknowledges delays in publishing its financial reports, which previously led to a trading suspension of its stock. However, following the release of the latest financial statements and compliance with regulatory requirements, trading in the company’s shares has resumed. The management emphasizes its commitment to improved reporting processes to ensure timely disclosures moving forward.

Monnari Trade S.A. (MON) – Further Buybacks

P/TB 0.44 │ URL

Monnari Trade S.A. has continued its share buyback program, acquiring a total of 24,438 shares between March 3 and March 7, 2025, at an average price ranging from PLN 5.01 to PLN 5.18 per share. The purchased shares represent a small fraction of the company’s total share capital, with Monnari Trade now holding 5,383,294 of its own shares, equivalent to 17.61% of total capital and 15.32% of voting rights. The repurchased shares may be redeemed, resold, pledged, or used for financial transactions, including acquisitions.

Remak Energomontaz (RMK) – FY2024

P/TB 0.53│ URL

Remak-Energomontaż S.A. reported net sales revenue of PLN 237.4 million for 2024, an increase from PLN 209.7 million in 2023. The cost of goods sold rose to PLN 211.1 million compared to PLN 182.3 million in the previous year, resulting in a gross profit of PLN 26.3 million, slightly lower than the PLN 27.4 million recorded in 2023. General administrative expenses increased to PLN 20.2 million, leading to an operating profit of PLN 6.1 million, down from PLN 9.4 million in the prior year. RMK. also reported other operating income of PLN 11.4 million, slightly lower than PLN 12.3 million in 2023, mainly driven by asset disposals and financial adjustments.

Stalprodukt (STP) – Tender Offer (again)

P/TB 0.41│ URL

Stalprodukt S.A. has launched an offer to purchase up to 108,163 of its own shares for redemption (c. 2%), as approved by a shareholder resolution on June 26, 2024. The offer price per share is set at PLN 240.00, and the offer period runs from March 10 to March 21, 2025. Transactions will be processed outside the regulated market, with settlement scheduled for March 28, 2025, through KDPW.

Werth-Holz S.A. (WHH) - Announces Annual General Meeting on March 31, 2025

P/TB 0.46 │ URL

Werth-Holz S.A. has scheduled its Annual General Meeting (AGM) for March 31, 2025, at 11:00 AM at the notary's office in Warsaw. The agenda includes reviewing and approving the company’s separate and consolidated financial statements for the financial year ending September 30, 2024, along with the management board’s activity reports. Shareholders will also vote on the distribution of the financial result and granting discharge to members of the Supervisory and Management Boards for their duties during the financial year.

The writer may own shares of the companies mentioned. This communication is for informational purposes only. AI helped us with this. Check important info.