Companies mentioned

· Bowim (BOW) - Reports FY 2024 Loss, Revenue Down 12%

· Dekpol (DEK) - Posts Strong Operating Profit in 2024 Despite Revenue Decline

· Dębica (DBC) - Reports Lower Profits in 2024 Amid Decline in Sales

· Fasing (FSG) - Reports Lower Revenue and Profit in 2024 & Proposes Full Retention of 2024 Profit to Fund Transformation and Liquidity Needs

· Forte (FTE) - Reports Preliminary FY2024/25 Results: Sales and Profitability Boosted by Hedging Strategy and Cost Measures

· Izoblok (IZB) - Reports Decline in Revenue but Maintains Profitability in FY2024

· Izostal (IZS) - Doubles Sales in Q1 2025 on Major Pipeline Contracts & Declares PLN 0.09 Dividend per Share for 2024

· KPPD (KPD) - Reports Narrowed Net Loss in Q1 2025 Despite Flat Sales

· Lena Lighting (LEN) - Recommends PLN 0.10 Dividend for 2024

· Moj SA (MOJ) - Reports Net Profit Growth in 2024

· Maxcom (MXC) - Reports Consolidated Net Loss for 2024 Despite Positive Operating Cash Flow

· Relpol (RLP) - Reports 2024 Consolidated Net Loss Despite Strong Operating Cash Flow

· Remak-Energomontaż (RMK) - Reports Weak Profitability but Strong Cash Flow in Q1 2025 & Announces Dividend Payment for 2024

· Ropczyce (RPC) - Reports Consolidated Results for 2024 with Net Loss

· Rawlplug (RWL) - Reports Strong Growth in Net Profit for 2024

· Sanwil Holding (SNW) - Reports Lower Sales but Positive Net Result for 2024

· Stalprofil (STF) - Reports Higher Revenues but Weaker Profitability in 2024

· Trans Polonia (TRN) - Sees Revenue Growth but Lower Profits in 2024

· Tesgas (TSG) - Reports a Net Loss for 2024 Amid Sharp Revenue Decline

· Grupa Azoty Puławy (ZAP) - Reports Estimated 2024 Results with Continued Pressure from Imports

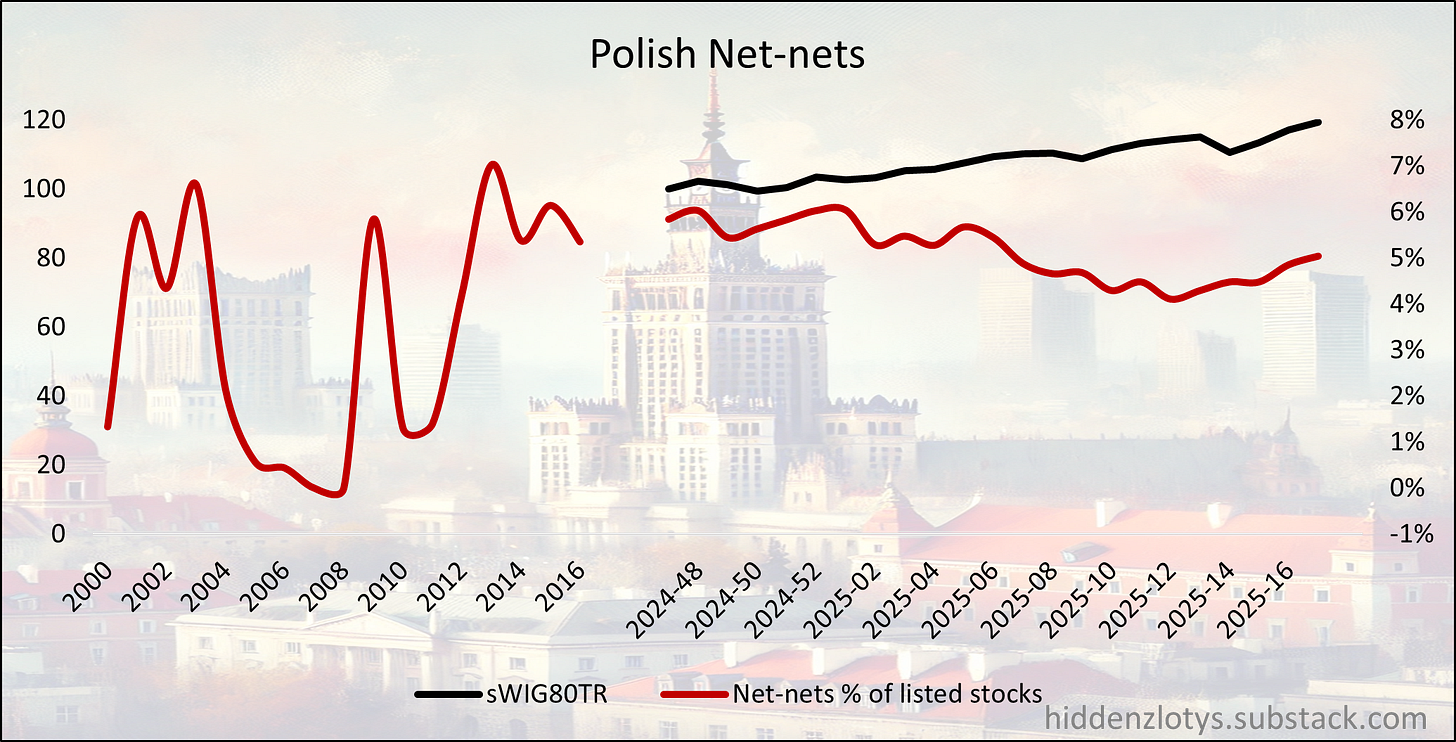

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

Bowim (BOW) - Reports FY 2024 Loss, Revenue Down 12%

P/TB 0.29 │ URL

BOWIM S.A. has published its consolidated annual report for 2024, showing a decline in operating income to PLN 1,829m (–11.7% y/y) and a net loss of PLN –10.6m compared to a profit of PLN 13.3m in 2023. Operating profit fell sharply to PLN 4.7m from PLN 35.4m. Equity remained stable at PLN 315m, with total assets down slightly to PLN 542m. Net cash from operations dropped significantly to PLN 17.1m from PLN 120.7m. The company cites higher costs and weaker margins as key contributors to the downturn.

Dekpol (DEK) - Posts Strong Operating Profit in 2024 Despite Revenue Decline

P/TB 0.78 │ URL

Dekpol S.A. published its consolidated financial report for the fiscal year 2024, showing robust profitability despite a drop in revenues. The group’s net revenues amounted to PLN 1.4 billion, a decrease from PLN 1.57 billion in 2023. Despite this, operating profit rose to PLN 120.8 million, compared to PLN 115.9 million the previous year, and net profit increased to PLN 96.5 million, up from PLN 90.4 million in 2023.

The company also reported a gross profit of PLN 122.4 million, with earnings per share improving to PLN 11.54 (from PLN 10.81). Book value per share rose to PLN 76, reflecting a stronger equity position. Dekpol’s total assets grew to PLN 1.68 billion, while equity increased to PLN 639 million.

Cash flow from operating activities was negative at –PLN 23.0 million, contrasting with PLN 97.1 million in 2023. However, this was largely offset by PLN 70.8 million in positive cash flow from financing activities, resulting in a total net cash inflow of PLN 35.5 million for the year.

Dębica (DBC) - Reports Lower Profits in 2024 Amid Decline in Sales

P/TB 0.86 │ URL

Tire Company Dębica S.A. reported a 15% year-on-year decline in revenue for 2024, amounting to PLN 2.52 billion, compared to PLN 2.96 billion in 2023. Despite the drop in sales, the company posted a net profit of PLN 77.8 million, significantly lower than the PLN 284.4 million achieved the previous year. Operating profit fell sharply to PLN 58.3 million (from PLN 322.2 million), and net cash flow turned negative at –PLN 144.6 million versus a positive PLN 112.7 million in 2023. The company's total assets declined slightly to PLN 2.32 billion, while equity decreased to PLN 1.37 billion. Earnings per share dropped from PLN 20.60 to PLN 5.63, but the company declared a higher dividend of PLN 10.30 per share, up from PLN 3.95.

Fasing (FSG) - Reports Lower Revenue and Profit in 2024 & Proposes Full Retention of 2024 Profit to Fund Transformation and Liquidity Needs

FASING Group, a manufacturer of mining equipment and metal tools, reported a year-on-year decline in revenue in 2024 to PLN 266.9m (–9%), while net profit also slipped to PLN 15.5m from PLN 17.0m in 2023. Operating profit dropped to PLN 25.7m (from PLN 38.1m), and cash flow from operations was significantly lower at PLN 5.3m versus PLN 50.6m a year earlier. Despite the decline in earnings, the company’s equity base improved to PLN 194.5m and book value per share rose to PLN 62.59. Long-term liabilities fell sharply to PLN 14.4m, suggesting efforts to deleverage. Overall, the company remained profitable, but faced reduced margins and liquidity pressure.

On April 28, 2025, the Management Board of FASING SA proposed to allocate the entire 2024 net profit of PLN 14.4m to reserve capital, with the aim of financing strategic investments such as the "FASING TRANSFORMATION" project focused on environmental and market diversification, and to support financial liquidity amid expected delays in customer payments and higher inventory levels; the Supervisory Board issued a favorable opinion, and the final decision will be made at the General Meeting.

Forte (FTE) - Reports Preliminary FY2024/25 Results: Sales and Profitability Boosted by Hedging Strategy and Cost Measures

P/TB 0.73 │ URL

FORTE Group announced preliminary financial results for FY 2024/25 (ended March 31), reporting a 7% increase in consolidated sales to PLN 1,101m and a sharp turnaround in EBIT from PLN -2m to PLN 71m, with Q4 EBIT reaching PLN 36m versus PLN 1m a year earlier; EBITDA more than doubled to PLN 127m for the full year, supported by operational efficiencies and a currency hedging strategy that offset the strengthening of the PLN, contributing PLN 75.9m to annual EBIT and revenue, while additional revenue of PLN 9.3m from CO₂ allowance sales was booked by subsidiary TANNE; the net debt-to-EBITDA ratio stood at 1.6x, within covenant limits, with final audited figures to follow in the FY report.

Izoblok (IZB) - Reports Decline in Revenue but Maintains Profitability in FY2024

P/TB 0.48 │ URL

In the 2024 financial year, IZOBLOK reported a 41% decline in consolidated revenue to PLN 252.3m (from PLN 429.5m in 2023), reflecting weaker market dynamics, yet managed to maintain profitability, with net profit of PLN 13.9m and operating profit of PLN 6.2m; cash flow from operations stood at PLN 10.9m, and a positive investing cash flow of PLN 40.3m (mainly due to asset transactions) helped offset negative financing outflows of PLN -44.3m; the company strengthened its balance sheet with total assets rising to PLN 285.3m and equity up 15% to PLN 102.2m, despite a slight pre-tax loss and the significant shift in liabilities toward long-term debt, indicating strategic restructuring or refinancing.

Izostal (IZS) - Doubles Sales in Q1 2025 on Major Pipeline Contracts & Declares PLN 0.09 Dividend per Share for 2024

Izostal S.A. reported a sharp increase in preliminary Q1 2025 revenue to PLN 305.4m, up 100% y/y from PLN 152.8m, driven by large-scale pipeline deliveries for OGP Gaz-System and Ferrum related to the onshore section of the FSRU terminal project in Gdańsk Bay; gross profit rose 84% to PLN 25.6m and EBITDA increased 26% to PLN 11.5m, while net profit edged up just 2% y/y to PLN 3.2m, as higher sales volumes were offset by increased selling and interest costs linked to contract financing amid elevated interest rates.

On April 25, 2025, Izostal’s Ordinary General Meeting approved the Management Board’s proposal to allocate PLN 2.95m of 2024 net profit for dividend distribution, resulting in a payout of PLN 0.09 per share across all 32.74 million shares; the dividend record date is set for July 7, 2025, with payment to be made on July 21, 2025.

KPPD (KPD) - Reports Narrowed Net Loss in Q1 2025 Despite Flat Sales

P/TB 0.42 │ URL

KPPD-Szczecinek SA announced preliminary Q1 2025 results, showing sales of PLN 88.8m (vs. PLN 88.1m in Q1 2024), a slight improvement in gross profit on sales to PLN 6.5m (up from PLN 6.1m), and a significantly reduced net loss of PLN -5.9m compared to PLN -8.7m a year earlier; EBITDA turned marginally positive at PLN 0.3m (from PLN -3.3m), though all figures remain subject to adjustment in the final report due May 15, 2025.

Lena Lighting (LEN) - Recommends PLN 0.10 Dividend for 2024

P/TB 0.67 │ URL

The Management Board of Lena Lighting SA has recommended a dividend of PLN 0.10 per share for the 2024 financial year, stating that the company’s current financial standing supports both the payout and the continuation of its investment program without operational disruption; the proposal has been submitted to the Supervisory Board and will be voted on at the upcoming General Meeting.

Moj SA (MOJ) - Reports Net Profit Growth in 2024

P/TB 0.41 │ URL

Moj SA’s 2024 annual report shows net revenue of PLN 73.2m (down 6% y/y), a net profit of PLN 3.1m (up 26% y/y), and EBITDA of PLN 0.3m (vs. negative net cash from operations of PLN -1.0m); equity increased to PLN 42.6m, liabilities remained flat at PLN 41.2m, and net cash flow turned marginally positive, while book value per share rose to PLN 4.34.

Maxcom (MXC) - Reports Consolidated Net Loss for 2024 Despite Positive Operating Cash Flow

P/TB 0.36 │ URL

Maxcom S.A. reported 2024 consolidated sales revenues of PLN 112.5m (down 19% y/y), an operating profit of PLN 0.9m (down 82% y/y), and a consolidated net loss of PLN -1.1m compared to a profit of PLN 0.6m in 2023; positive operating cash flow reached PLN 7.3m, but financing cash outflows led to an overall negative net cash flow of PLN -0.4m, while total equity declined to PLN 54.3m and the company maintained a strong balance sheet structure.

Relpol (RLP) - Reports 2024 Consolidated Net Loss Despite Strong Operating Cash Flow

P/TB 0.62 │ URL

Relpol S.A. reported consolidated 2024 sales revenues of PLN 109.3m (down 31% y/y), an operating loss of PLN -6.8m, and a net loss of PLN -7.5m versus a net profit of PLN 8.6m in 2023; despite the decline in profitability, operating cash flow was positive at PLN 16.0m, helping to partly offset negative investing and financing flows, while total assets decreased to PLN 135.2m and equity fell to PLN 96.7m.

Remak-Energomontaż (RMK) - Reports Weak Profitability but Strong Cash Flow in Q1 2025 & Announces Dividend Payment for 2024

In Q1 2025, Remak-Energomontaż SA posted net sales of 40.2 msek, slightly down from 42.5 msek a year earlier. Operating profit improved to 1.4 msek from 0.4 msek, while gross profit reached 0.3 msek. However, net profit dropped sharply to 0.1 msek compared to 2.2 msek in Q1 2024. Free cash flow turned positive at 8.5 msek, reversing a negative 3.5 msek figure last year, mainly due to strong financing inflows. The company's equity remained stable at 76.2 msek. Despite positive cash generation, declining revenue and very low profitability signal continued business risks.

On April 24, 2025, the Annual General Meeting of Remak-Energomontaż S.A. approved the payment of a dividend of 900,000 PLN, equivalent to 0.30 PLN per share, covering all 3,000,000 shares issued by the company. The dividend record date is set for May 6, 2025, and the payment will be made on July 8, 2025.

Ropczyce (RPC) - Reports Consolidated Results for 2024 with Net Loss

P/TB 0.35 │ URL

ROPCZYCE S.A. published its consolidated 2024 results, reporting net revenues of 429,815 thousand PLN, down from 446,386 thousand PLN in 2023. Operating profit decreased significantly to 6,794 thousand PLN from 33,464 thousand PLN, while the company posted a net loss of -1,053 thousand PLN compared to a net profit of 15,704 thousand PLN the previous year. Cash flow from operating activities improved to 51,496 thousand PLN, but cash outflows were reported from both investing (-20,056 thousand PLN) and financing (-91,909 thousand PLN) activities. Total equity remained stable at 401,035 thousand PLN.

Rawlplug (RWL) - Reports Strong Growth in Net Profit for 2024

P/TB 0.97 │ URL

Rawlplug S.A. released its 2024 consolidated annual results, reporting net sales revenues of 1,133,390 thousand PLN, slightly lower than 2023 levels. Despite the small decline in sales, operating profit rose to 99,652 thousand PLN (up from 91,133 thousand PLN in 2023), and net profit attributable to shareholders increased significantly to 53,014 thousand PLN compared to 32,612 thousand PLN a year earlier. Net cash flow from operating activities decreased to 123,321 thousand PLN from 154,874 thousand PLN. Total assets grew to 1,451,372 thousand PLN, while equity attributable to shareholders also rose to 682,302 thousand PLN.

Sanwil Holding (SNW) - Reports Lower Sales but Positive Net Result for 2024

P/TB 0.37 │ URL

Sanwil Holding S.A. published its consolidated annual report for 2024, showing a decline in sales revenue to 27,361 thousand PLN from 31,415 thousand PLN the year before. Despite the revenue drop, the company posted a net profit of 1,341 thousand PLN, down from 5,699 thousand PLN in 2023. Operating profit turned negative at -588 thousand PLN compared to a positive 1,758 thousand PLN a year earlier. Net cash flow from operating activities improved to 3,646 thousand PLN, while the balance sheet remained stable with total assets of 74,828 thousand PLN. Equity increased slightly to 60,788 thousand PLN.

Stalprofil (STF) - Reports Higher Revenues but Weaker Profitability in 2024

P/TB 0.32 │ URL

Stalprofil S.A. published its consolidated annual report for 2024, showing net sales of 1,704 mPLN (up from 1,534 mPLN in 2023), but operating profit declined to 27.9 mPLN from 37.2 mPLN. Net profit attributable to shareholders was 14.5 mPLN, slightly down from 15.6 mPLN the previous year. Cash flow from operating activities turned negative at -89.6 mPLN compared to a positive 162.7 mPLN a year earlier, while assets grew to 1,297 mPLN. Short-term liabilities increased significantly, suggesting some potential liquidity pressure despite a relatively stable equity position.

Trans Polonia (TRN) - Sees Revenue Growth but Lower Profits in 2024

P/TB 0.41 │ URL

Trans Polonia S.A. reported a 7.6% increase in consolidated net sales for 2024 to 221.2 mPLN but recorded a sharp decline in profitability, with net profit falling to 2.5 mPLN from 6.2 mPLN in 2023. Operating profit decreased to 2.9 mPLN (previously 4.0 mPLN). Cash flow from operating activities strengthened to 23.8 mPLN, while total assets remained stable at around 242 mPLN. The company paid a dividend of 0.11 PLN per share, a reduction compared to 0.50 PLN per share in the previous year, reflecting weaker financial results.

Tesgas (TSG) - Reports a Net Loss for 2024 Amid Sharp Revenue Decline

P/TB 0.35 │ URL

Tesgas S.A. published its consolidated results for 2024, showing a 43% drop in sales revenue to 80.1 mPLN, compared to 140.4 mPLN in 2023. The company swung to a net loss of -291 kPLN, versus a net profit of 4.3 mPLN a year earlier. Operating activities generated positive cash flow of 7.8 mPLN, but the company reported an overall net cash outflow of -4.7 mPLN for the year. Total assets remained stable at around 124.2 mPLN, while equity slightly decreased to 88.3 mPLN. The sharp revenue decline and negative bottom line highlight financial pressure and business risks.

Grupa Azoty Puławy (ZAP) - Reports Estimated 2024 Results with Continued Pressure from Imports

P/TB 0.36 │ URL

Grupa Azoty Puławy published estimated results for Q4 and FY2024, reporting Q4 consolidated sales of 898 mPLN and EBITDA of 69 mPLN (EBITDA margin 7.7%), supported by asset impairment reversals and deferred tax asset recognition (+148 mPLN impact). Full-year 2024 sales reached 3,481 mPLN, but EBITDA was still negative at -201 mPLN (margin -5.8%), an improvement of 137 mPLN year-on-year. Fertilizer imports from Russia and Belarus surged (+150% y/y), impacting pricing and margins, while weak plastics demand and volatile gas prices further pressured operations. Final audited figures are expected on April 29, 2025.

The writer may own shares of the companies mentioned. This communication is for informational purposes only. AI helped us with this. Check important info.