Market: 5

Companies mentioned

· Amica (AMC) - Q1 2025 Marked by Decline in Revenue and Profitability

· Bowim (BOW) - Q1 2025 Sees Earnings Dip Despite Stable Revenue and Positive Operating Cash Flow

· Dekpol (DEK) - Strong Operating Result and Cash Flow in Q1 2025 Despite Slight Revenue Dip & Signs Major Logistics Park Contract with EQT Real Estate

· Hydrotor (HDR) - Continued Losses in Q1 2025, But Positive Operating Cash Flow

· KPPD (KPD) - Leaseback Deal to Strengthen Liquidity and Restructure Financing

· Pepees (PPS) - Return to Profit in Q1 2025 on Strong Revenue Growth and Operating Cash Flow

· Relpol (RLP) - Continued Losses and Revenue Decline in Q1 2025 Despite Stable Balance Sheet

· Ropczyce (RPC) - Back to Operational Profit in Q1 2025 Despite Bottom-Line Loss

· Stalprofil (STF) - Q1 2025: Strong Revenue Growth, but Profitability Under Pressure

· Stalprodukt (STP) - Q1 2025: Continued Losses Despite Higher Revenues

· Tesgas (TSG) - Expects Q1 2025 Loss Due to

Sharp Revenue Decline and Margin Pressure

· Grupa Azoty Puławy (ZAP) - Posts Marginal Q1 EBITDA Amid Import Pressure and Rising Gas Costs

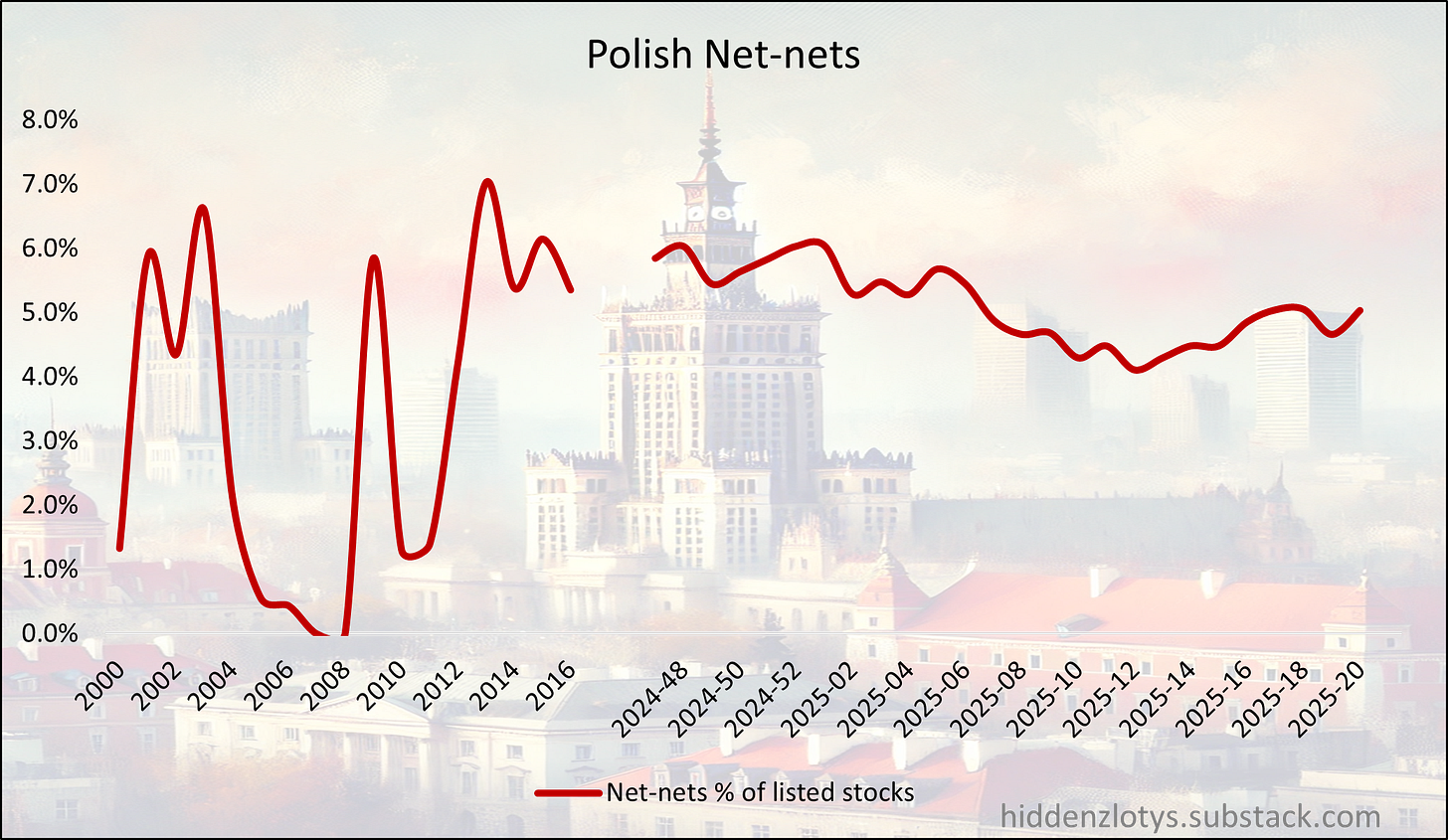

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

Amica (AMC) - Q1 2025 Marked by Decline in Revenue and Profitability

P/TB 0.57 │ URL

In its Q1 2025 extended consolidated report, Amica S.A. reported a year-on-year revenue decline of 9.8% to PLN 566.9 million (from PLN 628.4 million). Operating profit dropped sharply to PLN 3.1 million from PLN 8.1 million, and the company posted a net loss of PLN 6.7 million compared to a profit of PLN 3.1 million in the same period last year. Gross result turned negative at -PLN 4 million versus a positive PLN 1.8 million in Q1 2024. Operating cash flow was significantly negative at -PLN 22.8 million, down from PLN +46.5 million a year earlier. Total net cash flow stood at -PLN 28.6 million. Despite these challenges, equity attributable to shareholders remained relatively stable at PLN 1,034.3 million, though short-term liabilities still account for a substantial portion of the balance sheet at PLN 761.4 million. The company declared a dividend of PLN 2.00 per share, down from PLN 2.50 last year.

Bowim (BOW) - Q1 2025 Sees Earnings Dip Despite Stable Revenue and Positive Operating Cash Flow

P/TB 0.27 │ URL

Bowim S.A. reported consolidated Q1 2025 revenue of PLN 446.2 million, slightly down from PLN 462.1 million in Q1 2024. Operating profit decreased to PLN 3.4 million (from PLN 7.9 million), and the group recorded a net loss of PLN 1.9 million, compared to a net profit of PLN 3.6 million a year earlier. Gross profit turned negative at -PLN 2.0 million. Despite the weaker bottom line, net cash flow from operating activities improved to PLN 13.7 million (vs. PLN 11.9 million in Q1 2024). Total assets increased to PLN 574.2 million, while liabilities rose to PLN 261.5 million, with short-term liabilities making up a significant portion. Equity slightly decreased to PLN 312.7 million. Book value per share stood at PLN 16.02.

Dekpol (DEK) - Strong Operating Result and Cash Flow in Q1 2025 Despite Slight Revenue Dip & Signs Major Logistics Park Contract with EQT Real Estate

Dekpol S.A. reported net revenue of PLN 343.0 million in Q1 2025, slightly below the PLN 351.3 million posted a year earlier. However, the company significantly improved profitability, with operating profit rising to PLN 46.6 million (from PLN 26.3 million) and net profit increasing to PLN 30.4 million from PLN 24.5 million. Net cash flow from operating activities more than tripled to PLN 82.2 million. Despite increased short-term liabilities (up to PLN 620.0 million from PLN 566.6 million), equity rose to PLN 672.1 million, and total assets reached PLN 1.75 billion. Book value per share climbed to PLN 80.37. No going concern issues were noted, and the strong operating margin and cash flow support a solid financial position despite rising financing and investment cash outflows.

Dekpol S.A. announced the signing of a construction contract via its subsidiary Dekpol Budownictwo with an entity from the EQT Real Estate group for a logistics park in the Silesian Voivodeship. The project includes four warehouse halls and related infrastructure, structured under a lump-sum “design and build” model. Stage one, valued at approx. 5% of Dekpol Group’s 2024 sales revenue, is due in Q4 2025 (or Q1 2026 if converted into cold storage). The following three stages are optional and can be activated within six months, totaling an additional approx. 8% of 2024 revenue. The agreement includes contractual penalties for delays and defects, capped at 12% of the net remuneration per stage, with the right to claim additional damages. This deal adds to Dekpol’s order backlog and strengthens its presence in the industrial construction segment.

Hydrotor (HDR) - Continued Losses in Q1 2025, But Positive Operating Cash Flow

P/TB 0.45 │ URL

Hydrotor S.A. reported Q1 2025 consolidated revenue of PLN 30.8 million, up from PLN 28.9 million in Q1 2024. Despite the revenue growth, the company remained in the red, posting a net loss of PLN 1.5 million (vs. PLN -1.8 million in Q1 2024) and an operating loss of PLN 1.5 million. EBITDA came in at PLN 1.6 million, slightly above last year. Notably, Hydrotor turned to positive operating cash flow of PLN 239k, a recovery from the PLN -2.9 million outflow a year earlier. Total assets were relatively stable at PLN 185.9 million, while liabilities decreased to PLN 70.0 million, improving the equity position to PLN 115.9 million. Book value per share rose marginally to PLN 48.33.

KPPD (KPD) - Leaseback Deal to Strengthen Liquidity and Restructure Financing

P/TB 0.42 │ URL

KPPD-Szczecinek S.A. has entered into leaseback agreements with Pekao Leasing, involving the sale of four fixed assets followed by operating lease arrangements for the same assets. The transaction provided the company with a net cash inflow of PLN 1.58 million. The lease liabilities will be repaid over 59 monthly installments. The main goal of the deal is to improve financial liquidity and adjust the company's financing structure. The move suggests active management of working capital and funding flexibility, without indicating any immediate financial distress.

Pepees (PPS) - Return to Profit in Q1 2025 on Strong Revenue Growth and Operating Cash Flow

P/TB 0.48 │ URL

Pepees S.A. reported a significant improvement in Q1 2025, posting a net profit of PLN 0.56 million compared to a loss of PLN 4.05 million in Q1 2024. Revenue rose sharply by 38% year-on-year to PLN 72.1 million. The group also more than doubled its net operating cash flow to PLN 29.8 million, up from PLN 15.9 million a year earlier. Despite high cash outflows from financing activities (PLN -49.3 million), the overall cash position declined by PLN 21.1 million. Total assets decreased to PLN 314.4 million (from PLN 357.0 million), while equity remained stable at PLN 165.5 million. Book value per share was PLN 1.74. The results point to a recovery in operations and liquidity, although the drop in total assets and high financing outflows warrant monitoring.

Relpol (RLP) - Continued Losses and Revenue Decline in Q1 2025 Despite Stable Balance Sheet

P/TB 0.64 │ URL

Relpol S.A. reported a consolidated net loss of PLN 2.0 million in Q1 2025, slightly wider than the PLN 1.8 million loss in the same period last year. Revenue dropped by 13% year-on-year to PLN 27.2 million. Operating and gross profit figures also remained negative, with operating loss reaching PLN -2.1 million. Cash flow from operating activities decreased significantly to PLN 1.9 million (from PLN 9.2 million in Q1 2024), while total cash flow was slightly negative at PLN -0.3 million. On the balance sheet, assets stood at PLN 132.1 million, with equity slightly down to PLN 94.6 million. Book value per share was PLN 9.85, and no dividend was declared. The financials indicate continued pressure on profitability and cash flow generation, though no explicit going concern risks were reported.

Ropczyce (RPC) - Back to Operational Profit in Q1 2025 Despite Bottom-Line Loss

P/TB 0.34 │ URL

Ropczyce S.A. posted Q1 2025 consolidated sales of PLN 105.0 million, down 12% year-on-year. Despite lower revenue, the company returned to positive operating profit of PLN 3.7 million (vs. PLN -8.9 million in Q1 2024) and marginal gross profit of PLN 0.2 million. However, it still ended the quarter with a net loss of PLN 0.2 million, significantly improved from PLN -9.4 million last year. Operating cash flow was strong at PLN 24.7 million, compared to an outflow of PLN -15.6 million in Q1 2024. Equity remained stable at PLN 401.1 million, with book value per share at PLN 71.96. Short-term liabilities declined slightly, and total assets were largely unchanged. Overall, the report shows improving operational performance and liquidity, but the company is still working its way back to net profitability.

Stalprofil (STF) - Q1 2025: Strong Revenue Growth, but Profitability Under Pressure

P/TB 0.30 │ URL

Stalprofil reported a sharp increase in consolidated revenue in Q1 2025, reaching PLN 573.3 million (up from PLN 349.3 million in Q1 2024, +64%). However, operating profit decreased to PLN 8.4 million (from PLN 10.1 million), and net profit attributable to shareholders dropped significantly to PLN 1.2 million (from PLN 5.1 million). Earnings per share fell to PLN 0.07 (from PLN 0.29). Cash flow from operating activities improved strongly to PLN 46.9 million (from a negative PLN 26.9 million), offsetting the weak earnings. Total net cash change was positive at PLN 19.9 million. The balance sheet remains solid: equity held steady at PLN 504.5 million, while liabilities increased slightly (short-term +5%, long-term stable).

Stalprodukt (STP) - Q1 2025: Continued Losses Despite Higher Revenues

P/TB 0.38 │ URL

In the first quarter of 2025, Stalprodukt reported net sales of PLN 1.03 billion, up from PLN 898 million in the same period last year. Despite the revenue growth, the company remained loss-making, posting a net loss of PLN 18.7 million (compared to a loss of PLN 41 million in Q1 2024), with a loss per share of PLN 3.46. Operating profit remained negative at PLN -21.5 million, though improved year-on-year. Cash flow from operations was significantly negative at PLN -132 million, marking a sharp deterioration from a positive PLN 22 million in the previous year, and contributing to a total net cash outflow of PLN 153.7 million. Investment activity remained moderate, while financing activities showed a small inflow. The balance sheet remained stable, with total assets of PLN 4.8 billion and equity at PLN 3.76 billion. Short-term liabilities were slightly reduced, while long-term debt was largely unchanged. The company declared a dividend of PLN 6.00 per share for 2024, despite ongoing losses.

Tesgas (TSG) - Expects Q1 2025 Loss Due to Sharp Revenue Decline and Margin Pressure

P/TB 0.31 │ URL

TESGAS S.A. announced preliminary financial estimates for Q1 2025, indicating a net loss both on consolidated and standalone levels. The group’s revenue fell sharply by 44.5% year-on-year to PLN 12.2 million, resulting in a gross loss of PLN 1.0 million and an operating loss (EBIT) of PLN 4.8 million. Net loss reached PLN 4.3 million, compared to breakeven in Q1 2024. The parent company also reported a standalone net loss of PLN 2.0 million on revenues of PLN 8.6 million, down 43.8%. The management attributes the losses to weaker sales margins unable to cover fixed costs, unfavorable contract renegotiations due to subcontractor costs, and elevated material procurement expenses amid market volatility. Despite the loss, equity remained relatively stable at PLN 83.3 million. Final results will be published on May 30, 2025.

Grupa Azoty Puławy (ZAP) - Posts Marginal Q1 EBITDA Amid Import Pressure and Rising Gas Costs

P/TB 0.35 │ URL

Grupa Azoty Zakłady Azotowe "Puławy" S.A. reported preliminary consolidated sales revenues of PLN 1.1 billion for Q1 2025, with a negligible EBITDA of PLN 38 thousand (EBITDA margin of 0.003%). The weak performance was primarily attributed to continued pressure from fertilizer imports from Russia and Belarus, as well as a 75% year-over-year increase in natural gas prices. In the Agro segment, sales volumes of fertilizers increased by 37% y/y, supported by higher prices, but profitability remained negative with an EBITDA margin of -0.7% (up 8.2 p.p. y/y). Non-fertilizer chemical sales dropped by 23% y/y due to weak global demand, and melamine production remained halted. In the Plastics segment, caprolactam production was not resumed, resulting in an EBITDA loss of PLN 3 million. Final results will be released on May 28, 2025.

The writer may own shares of the companies mentioned. This communication is for informational purposes only. AI helped us with this. Check important info.