Market: 5

Companies mentioned

· Fasing (FSG) - signs PLN 24.7m chain delivery deal with JSW

· Izolacja-Jarocin (IZO) - shareholders plan full exit to SIT via tender offer

· Lena Lighting (LEN) - to pay PLN 0.10 dividend per share for 2024

· Rawlplug (RWL) - declares PLN 0.40 per share dividend for 2024

· Stalprofil (STF) - signs PLN 13.9m HDD drilling contract with PERN

· Trans Polonia (TRN) - acquires Nijman/Zeetank for up to €34.9m in major intermodal logistics expansion

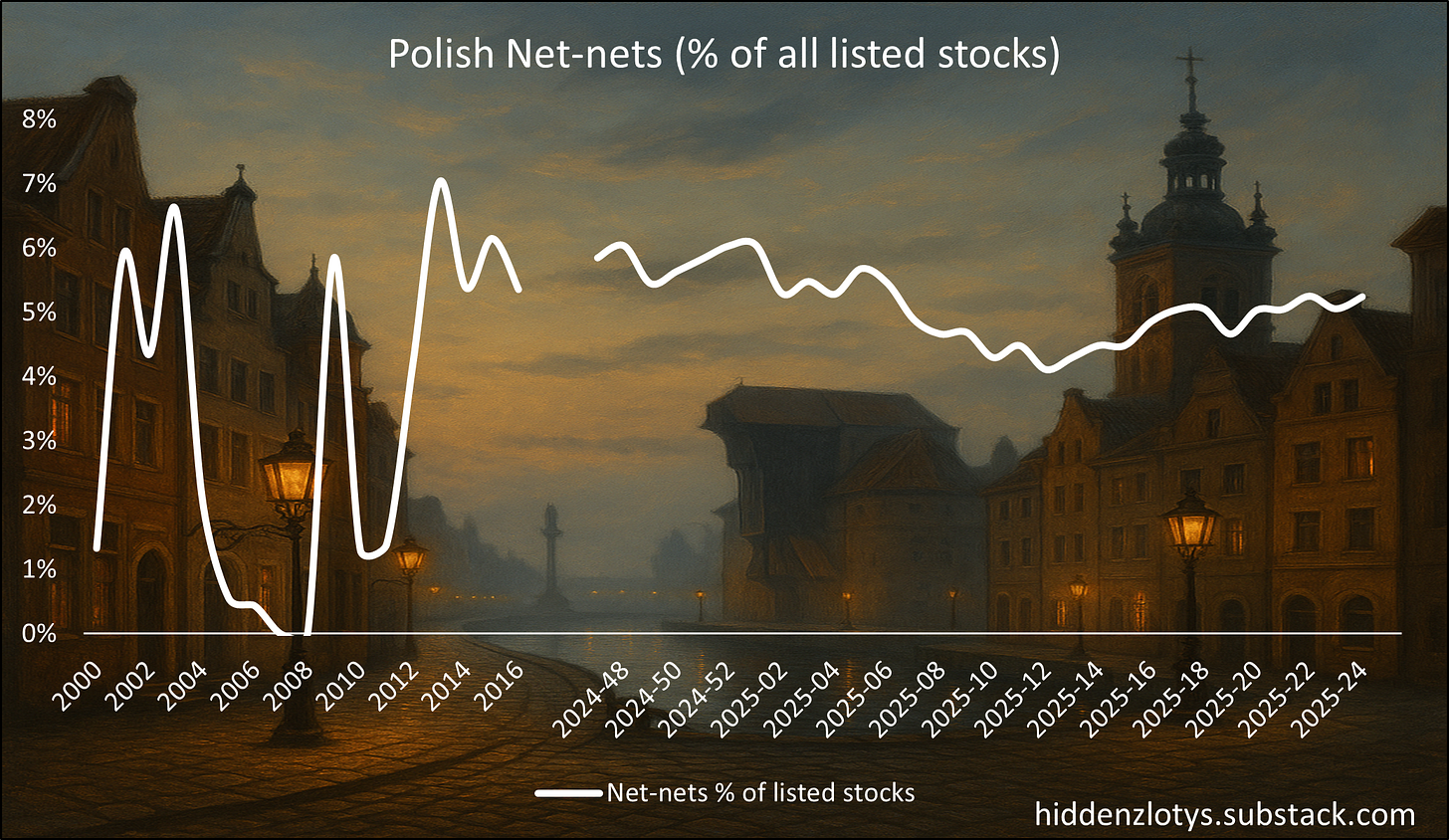

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable. Below is a net-net screen from Stockopedia.

Fasing (FSG) - signs PLN 24.7m chain delivery deal with JSW

P/TB 0.22 │ URL

Polish mining equipment manufacturer FASING SA has signed a delivery agreement with Jastrzębska Spółka Węglowa SA (JSW) for mining link chains worth PLN 24.7 million gross. Deliveries will be made in parts over 12 months, based on individual orders specifying quantities, timelines, and destinations. The deal includes general terms, technical specifications, and the supplier’s offer. Including this contract, FASING has signed agreements with JSW totaling PLN 26.5 million gross since September 2024, all related to mining chains and accessories.

Izolacja-Jarocin (IZO) - shareholders plan full exit to SIT via tender offer

P/TB 0.77 │ URL

The main shareholders of IZOLACJA-JAROCIN SA have signed an agreement with Selena Industrial Technologies (SIT) to sell 100% of the company’s shares via a tender offer. The offer, covering 3.8 million shares at PLN 3.50 per share, is expected to be launched within five business days. The transaction is conditional on regulatory approval from the Polish antitrust authority. A parallel agreement also involves SIT acquiring full control of TES sp. z o.o., making the deal part of a broader consolidation. The company will issue separate updates as regulatory milestones are met.

Lena Lighting (LEN) - to pay PLN 0.10 dividend per share for 2024

P/TB 0.65 │ URL

Lena Lighting SA's Ordinary General Meeting has approved a dividend payment of PLN 2.49 million, combining the 2024 net profit of PLN 2.31 million and retained earnings of PLN 181k. Shareholders will receive PLN 0.10 per share, with the record date set for June 23, 2025, and payment scheduled for July 3, 2025. The dividend applies to all 24,875,050 outstanding shares.

Rawlplug (RWL) - declares PLN 0.40 per share dividend for 2024

P/TB 0.94 │ URL

On June 18, 2025, Rawlplug SA’s Annual General Meeting approved a dividend payout of PLN 12.42 million from its 2024 net profit, corresponding to PLN 0.40 per share. The dividend applies to all 31,059,401 shares outstanding. The record date for shareholders entitled to receive the dividend is August 14, 2025, with payment scheduled for August 29, 2025.

Stalprofil (STF) - signs PLN 13.9m HDD drilling contract with PERN

P/TB 0.31 │ URL

Stalprofil SA has signed a construction contract with PERN SA for horizontal directional drilling (HDD) under the Vistula River, related to final product pipelines. The deal is valued at PLN 13.9 million net, and the work is scheduled to be completed within 38 weeks from signing on June 10, 2025. The agreement follows the selection of Stalprofil’s bid earlier in June.

Trans Polonia (TRN) - acquires Nijman/Zeetank for up to €34.9m in major intermodal logistics expansion

P/TB 0.50 │ URL

Trans Polonia S.A. has agreed to acquire 100% of Dutch logistics firm Nijman/Zeetank Holding B.V. and its affiliate N & K Equipment B.V. in a deal worth up to €34.9m, with an initial payment of €20m and the rest contingent on performance. The acquisition, financed entirely through bank debt, expands Trans Polonia’s reach in intermodal chemical and glass transport across Europe, especially in the Benelux, UK, and Poland. Nijman/Zeetank reported PLN 300m in revenue for 2024 and owns key assets including 648 vehicles, tank containers, and logistics bases, notably at the Port of Rotterdam. The deal adds warehousing, port access, and a new segment in glass transport, while Nijman/Zeetank’s general manager will remain in place to support integration.

The writer may own shares of the companies mentioned. This communication is for informational purposes only. AI helped us with this. Check important info.