The Polish Deep Value Week – 2024/46

Companies mentioned

Amica (AMC)

ASBISC (ASB)

Action (ACT)

Compremum (CPR)

Dekpol (DEK)

Debica (DBC)

Drozapol-Profil (DPL)

Feerum (FEE)

Forte (FTE)

Helio (HEL)

Libet (LBT)

MFO (MFO)

Moj (MOJ)

Mercator Medical (MRC)

Mostostal Zabrze (MSZ)

PA Nova (NVA)

Relpol (RLP)

Seko (SEK)

Stalprofil (STF)

Stalprodukt (STP)

Amica Group presents its long-term strategy for 2024-2030+, titled "Back to Profitability."

AMC │ Strategy Presentation │ P/TB 0.56 │Household Appliances │ URL

Poland's largest manufacturer of household appliances, AMC, aims to return to growth and increased profitability with the goal of becoming a dividend-paying company. The focus is on European markets and the heating equipment segment, where ESG plays a crucial role in achieving the targets. Amica's new strategy, "Back to Profitability," aims to ensure sustainable profitability by strengthening the production center in Wronki, Poland, and leveraging future opportunities, particularly following previous challenges such as the pandemic and market losses in Russia (approximately 5% of revenue before the war).

AMC plans for an annual sales growth of over 7% from 2030 and an EBITDA margin of 5% by 2027, expected to rise to 7% from 2030. The goal is to achieve a RONA (EBIT / Net Assets) of 14% by 2027 and over 17% by 2030. The company intends to keep net debt under 2 times EBITDA and improve the gross margin to 25% by 2027 and 28% by 2030. Despite a decline in revenue and a net loss in early 2024, AMC aims to double its EBITDA margins and strengthen its market position. Between 2002 and 2023, AMC demonstrated an annual sales growth of 5% and an average EBITDA margin of 6.25% - so the goal does seem plausible.

The strategy also includes a clear ESG initiative named "Action for Climate," with targets set for 2025 and 2030, as well as environmental goals for 2040 and 2050. A new cogeneration facility has been launched to improve production efficiency, and the company is also expanding into solar energy through its subsidiary Amica Energia, which plans to build a solar farm with a capacity of at least 30 MWp. A solar farm with a capacity of 30 MWp (megawatt-peak) means it can produce up to 30 megawatts under optimal conditions, equivalent to the electricity needs of approximately 1,500–2,000 households.

ASBISC – 3Q24 & Dividend

ASB │ New Report │ P/TB 0.89 │ Electronics Distribution │ URL

ASB is a leading distributor of information and communications technology products and solutions across the EMEA region, partnering with global tech vendors to deliver IT, IoT, and robotic products, solutions, and services. The company reports a challenging third quarter of 2024 with revenues of $722.5m, a decrease of 6.4% compared to the same period last year. Gross profit declined from 7.99% to 7.64%, and EBIT dropped by 31.7% to $19m. Net profit fell significantly to $9.5m, impacted by difficult market conditions in Kazakhstan (the most important market) due to new credit regulations and illegal trade, as well as the ongoing war in Ukraine. Total revenues for the first nine months amounted to $2.08 billion, down 4% year-over-year, with a net profit of $29.6m, compared to $50.9m in the previous year.

Despite the operational challenges, ASB reports progress in its proprietary brands. Canyon increased sales by 69% during the quarter, driven primarily by power banks and kids' smartwatches, while Prestigio Solutions grew revenues by 66%, benefiting from new product launches in the B2B segment. Lorgar underwent rebranding and anticipates revenue growth as new products become available.

ASB has also expanded into green energy, launching sales of solar panels, energy storage systems, and EV charging stations. Additionally, its distribution portfolio was enhanced through an agreement with Blackview covering 60 countries and a collaboration with RTV EURO AGD (leader of retail chains of electronics and household appliances in Poland ) in Poland via ASB’s wholly owned subsidiary Breezy.

ASB’s board has decided to pay an advance dividend for 2024 totaling $11.1m, equivalent to $0.20 per share for the company's 55.5 million shares. The record date is set for November 25, 2024, with the dividend to be distributed on December 5, 2024. The dividend level is now back to pre-covid levels.

Action SA – October sales & a buyback

ACT │ Financial Figures │ P/TB 0.68 │ Electronics Distribution │ URL / URL

ACT, active in the distribution of IT products, electronics, and household appliances, reports preliminary revenue of 244 mpln for October 2024, representing an increase of 7.02% compared to the same month in 2023. The company emphasizes that the group's gross margin remains stable and high at approximately 7.6%, consistent with historical averages.

ACT has conducted share buybacks under its own repurchase program, authorized by the general meeting on June 19, 2024. Between October 31 and November 6, 2024, a total of 11,873 shares were repurchased for approximately 202,215 PLN. These shares represent 0.0718% of the company's share capital and carry an equal percentage of voting rights at the general meeting. Following these transactions, the company holds a total of 1,142,923 treasury shares, representing 6.91% of the share capital and voting rights. Despite the buyback program, NOSH has increased in recent years. In 2021, ACT conducted a new share issuance of c. 3m shares at a price of 12 PLN per share. The largest shareholders have also been net sellers in recent times.

Compremum SA – The Vice CEO resigns but remains within the group.

CPR │ Management Change │ P/TB 0.31│ Construction │ URL

CPR, active in construction and woodworking products, announces that Agnieszka Grzmil has resigned from her role as Vice CEO of the company as of October 31, 2024, for personal reasons. However, she will remain within the COMPREMUM group, continuing as Vice CEO of the subsidiary SPC-2 Sp. z o.o. As of November 1, 2024, the company's management board consists of Bogusław Bartczak as CEO and Łukasz Fojt, who has been temporarily appointed as Vice CEO.

Dekpol – Plans to issue new bonds & changes the date for the next quarterly report.

DEK │ New Report │ P/TB 0.70 │ Construction │ URL / URL

DEK, active in construction, steel structures, and real estate development, plans to issue series N bonds and announces that the proceeds from the issuance, after deducting issuance costs, will first be used to purchase, redeem, or prepay the company’s series P2021A, P2021B, P2023A, or P2023B bonds up to an amount of 100 mpln. Any surplus above 100 mpln may be used to finance the group’s ongoing operations, with these funds available either simultaneously with or prior to the funds intended for bond refinancing.

DEK also announces a change to the publication date for the extended consolidated quarterly report for the third quarter of 2024. Originally scheduled for November 25, 2024, the report will now be published on November 28, 2024.

Dekpol has historically been one of the fastest-growing and highest-margin players in the Polish construction market over the past five years. Our analysis from earlier this year is available here.

Debica – Preliminary financials for 3Q24

DBC │ New Report │ P/TB 0.86 │ Rubber Tires │ URL

DBC is a leading Polish manufacturer of tires for passenger cars, vans, and trucks, operating as a listed subsidiary of The Goodyear Tire & Rubber Company (owns 87%) since 1995. The company reports preliminary results for the third quarter of 2024, with net revenue of 653.2 mpln and a net profit of 8.7 mpln. For the first nine months of 2024, net revenue amounted to 1,852.0 mpln and net profit to 67.8 mpln. The results were impacted by limited production capacity, lower sales prices, income from an advance payment of 151 mpln for fire compensation, and costs related to the fire in August 2023, which totaled 104.8 mpln. Following the third quarter, the company has restored full production capacity. Final results will be published on November 19, 2024.

Drozapol Profil – Mixed successes in VAT dispute.

DPL │ New Report │ P/TB 0.33 │ Steel Processing│ URL

DPL established in 1993 and based in Bydgoszcz, Poland, is a company that trades in metallurgical products, produces steel items, and offers transportation services. The company announced that on November 5, 2024, it received a decision from the Head of the Tax Administration Chamber in Bydgoszcz regarding VAT arrangements for the first, second, and third quarters of 2012. The decisions overturned previous rulings and concluded the case. The background includes prior court rulings where the Supreme Administrative Court and the Provincial Administrative Court in Bydgoszcz reviewed VAT objections for the 2012 quarters, with an ongoing appeal concerning the fourth quarter of 2012.

For the first three quarters of 2012, DPL effectively won the VAT dispute, as the Tax Administration Chamber in Bydgoszcz overturned earlier decisions and concluded the matter without further action. However, a dispute remains over the fourth quarter of 2012, where the company has appealed a decision from the Provincial Administrative Court in Bydgoszcz that dismissed their complaint.

Feerum – CEO purchases shares

FEE │ Insider Buy │ P/TB 0.96 │ Agricultural Machines & Systems │ URL

FEE is a leading manufacturer of grain silos and drying systems, specializing in innovative solutions for grain storage and drying. Daniel Janusz, CEO of FEE, has announced a share purchase in the company. The transaction took place on October 31, 2024, on the Warsaw Stock Exchange. He acquired a total of 6,116 shares at an average price of 9.6 PLN per share. Janusz has made several share purchases since 2018.

Forte – Calls for an extraordinary general meeting to elect a new board member.

FTE │ EGM │ P/TB 0.65 │ Furniture │ URL

During the extraordinary general meeting of FTE on December 4, 2024, the election of a new board member is planned to replace Agnieszka Zalewska, who has resigned from her position on the board. Information about the proposed candidate has not yet been disclosed. Zalewska has been a director in Forte since June 2022.

Helio – Preliminary financials for 1Q24/25

HEL │ New Report │ P/TB 0.56│ Food & Nutriton │ URL

HEL specializes in the production, import, and distribution of dried fruits, nuts, seeds, and grains, offering products under brands such as Helio, Słoneczne Owoce, and Helio Gold. The company reports preliminary results for the first quarter of the fiscal year 2024/2025 (July–September 2024). Revenue amounted to approximately 85.96 mpln, similar to the previous year's level of 83.95 mpln. However, net profit decreased by about 80% to 0.8 mpln compared to 4.27 mpln in the same period last year. The decline in profit is mainly attributed to a lower gross margin (0.9 percentage points lower) and increased financial costs related to negative foreign exchange differences, which rose to -2.83 mpln from -0.58 mpln the previous year. The full report will be published on November 29, 2024. HEL had a fantastically strong 4Q23 but seems now to be back in normal levels of profitability.

Libet – 3Q24

LBT │ New Report │ P/TB 0.89 │ Building Products │ URL

LBT is a leading manufacturer and distributor of concrete products, including paving stones, terrace slabs, and architectural concrete elements, serving both residential and commercial markets. During 3Q24 the company reported sales of 29.8 mpln, a significant decline from 50.0 mpln in the same period last year. The company recorded an operating loss of -0.4 mpln, compared to an operating profit of 4.0 mpln in Q3 2023. The net result after tax was -1.2 mpln, a drop from a net profit of 3.8 mpln during the previous year’s quarter.

Despite challenges such as reduced demand and difficult conditions in the construction sector, Libet has implemented measures to enhance profitability. These include cost reductions, such as a 33% decrease in production waste and a 47% reduction in office space. Additionally, the company has introduced new products to its portfolio and focused on operational efficiencies to stabilize future performance.

MFO – Preliminary financials 3Q24

MFO │ New Report │ P/TB 0.72 │ Steel Processing │ URL

MFO is a leading manufacturer of cold-formed steel profiles, including window reinforcements, special profiles for light steel constructions, and components for various industries such as automotive and furniture. The company reports preliminary figures for the first three quarters of 2024, showing significant deviations from the three-year average. Sales amounted to 468.4 mpln, an increase of 38.5 mpln compared to the same period in 2023, but a decrease of 28% compared to the three-year average. Operating profit (EBIT) reached 12.4 mpln, an increase of 11.0 mpln from 2023, but an 81% decrease compared to the average over the past three years. The net profit was 5.8 mpln, an increase of 11.6 mpln from 2023, but an 88% decrease from the three-year average. Final figures will be published on November 21, 2024.

Moj – More orders from Fasing

MOJ │ Order│ P/TB 0.41 │ Mining Equipment │ URL

MOJ specializes in manufacturing and distributing industrial couplings, drilling equipment, and mechanization devices for sectors including mining, energy, engineering, metallurgy, and cement. The company reports receiving orders from FASING S.A. (FSG) (which holds a 69% ownership stake in MOJ) with a total value of 3.1 mpln. These orders include forged components, scrapers, locks, links, and half-links. As of July 31, 2024, the total value of orders from FSG amounts to 9.8 mpln, compared to the total 3Q(R9) sales of 59 mpln.

FASING S.A. attempted to delist MOJ from the Warsaw Stock Exchange in 2020. On September 24, 2020, FASING entered into an agreement with other major shareholders to coordinate a tender offer to acquire all outstanding shares of MOJ. The objective was to achieve at least 95% ownership, followed by a compulsory buyout of the remaining shares and delisting from the exchange.

Mercator Medical – Insider sales in the buyback program.

MRC │ Insider Sell │ P/TB 0.65 │ URL

Wiesław Żyznowski, Chairman of the Board at Mercator Medical S.A., reported selling 7,985 shares at a price of 100 PLN per share on October 29, 2024. The transaction was conducted off-market as part of the company’s buyback program. Orpheus Sp. z o.o., an entity related to Wiesław and Urszula Żyznowska, simultaneously sold 2,129 shares at the same price and on similar terms.

Additionally, ANABAZA RAIF V.C.I.C. Ltd, another related entity, conducted two separate sales on October 29. The first sale involved 57,906 shares and the second 54,194 shares, both at a price of 100 PLN per share, also off-market and within the buyback program.

An updated ownership structure indicates that ANABAZA RAIF V.C.I.C. Ltd slightly reduced its stake, while Mercator Medical increased its holdings of treasury shares, marginally affecting the company’s share capital and voting rights.

In total, the company repurchased 122,214 shares from these parties at 100 PLN per share. This seems unusual given that the current share price is 54 PLN. On October 29, 2024, MRC executed a buyback transaction, acquiring a total of 149,000 shares at 100 PLN per share as part of a share sale offer announced on October 14, 2024. The shares acquired were intended for redemption and allocated as follows: 91,094 common shares and 57,906 preferred shares.

This raises questions about the rationale for such a premium-priced, targeted buyback and how it was executed under these conditions. Does anyone know what just happened here?

Mostostal Zabrze – A one-time event related to the Polwax transaction

MSZ │ Acquisition │ P/TB 1.08 │ URL

MSZ reports a one-time event significantly impacting the group's financial results for the third quarter of 2024. This pertains to an acquisition gain following the takeover of control of Polwax S.A. (PWX) On November 12, 2024, the fair value of Polwax's identifiable assets and liabilities was determined according to IFRS 3. The excess of the net asset value over the transaction price and minority interests resulted in a preliminary profit of approximately 27.3 mpln, which is recorded as a one-time gain in the group's Q3 2024 results. The final valuation of Polwax's net assets is yet to be completed and remains preliminary.

MSZ acquired a significant stake in Polwax S.A., a leading producer and distributor of refined and renewable paraffin in Poland. On May 24, 2024, MSZ signed a letter of intent with Polwax to subscribe for 30.8 million newly issued shares for a total of 30.8 mpln. After obtaining necessary approvals, including from the Polish competition authority, the transaction was completed on July 18, 2024. This acquisition gives MSZ approximately 49.92% ownership in Polwax, granting significant influence over the company. The acquisition is part of Mostostal Zabrze's 2023–2026 strategy, aimed at diversifying operations and expanding into new production segments.

PA Nova – Issues bonds

NVA │ Refinancing │ P/TB 0.32 │ Construction│ URL

NVA has decided to issue unsecured series C bonds in a continuous offering. The company will offer up to 75,000 bonds with a total nominal value of up to 7.5 million EUR, where each bond has a nominal value and issue price of 100 EUR. The bonds will have a maximum maturity of 2 years and 6 months before redemption. NVA also intends to apply for the bonds to be listed on the alternative trading platform Catalyst.

Relpol – New partnership in South Africa

RLP │ Partnership │ P/TB 0.62 │ Electronics │ URL

Elquip Solutions is a South African company specializing in supplying industrial equipment as well as electrical and mechanical components to the industry. Based in Boksburg, the company was founded in the 1980s by Mike Cronin and has grown into a leading supplier in its field.

One of Elquip Solutions' partners is RLP, which specializes in manufacturing electromechanical relays and other components for industrial automation. RLP has a global presence and offers products used in various industries, including power automation and electronics.

Through its partnership with RLP, Elquip Solutions can provide its customers in South Africa and the region with high-quality relays and related products, enhancing their portfolio in electrical components and industrial automation.

Seko – 3Q24

SEK │ New Report │ P/TB 0.76 │ Food & Nutrition│ URL

In the third quarter of 2024, SEK experienced a decline in both revenue and profitability compared to the same period last year. For the January–September 2024 period, sales revenue fell by 11.7% to 157 mpln, and net profit decreased to 3.9 mpln from 7.2 mpln in the previous year. Reduced sales volumes and increased production costs, particularly for wages and raw materials, negatively impacted the results. However, currency exchange rate fluctuations provided some relief through lower import costs.

Sales revenue in the third quarter of 2024 amounted to 52 mpln, a decrease of 4.7% compared to the same quarter in 2023. Higher summer temperatures contributed to reduced demand for fish products, one of the company's main goods. The company continued investing in modernizing its production facilities and energy supply, albeit with lower capital expenditures compared to earlier periods.

In the coming quarters, the company's results are expected to be influenced by consumer demand during the Christmas season, energy prices, and currency exchange rate fluctuations.

Stalprofil – ArcelorMittal relocates its holdings & new gas pipeline project

STF │ Ownership Change │ P/TB 0.31 │ Steel Processing│ URL

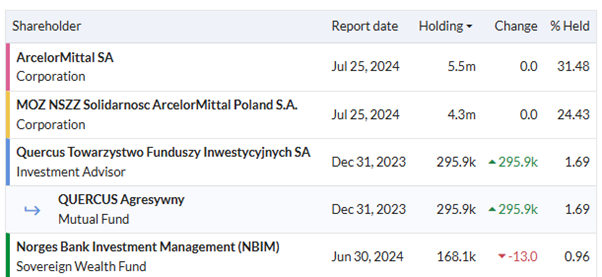

The board of STF announces that the company has received notifications under Article 69 of the Act on Public Offerings regarding a significant change in shareholding. On October 31, 2024, an internal restructuring within the ArcelorMittal group in Poland was registered, where ArcelorMittal Poland S.A. transferred part of its assets, including its entire shareholding in Stalprofil, to the newly established entity ArcelorMittal Investment Management Poland Sp. z o.o. ArcelorMittal is STF’s largest shareholder with a 56% holding. The ArcelorMittal group intends to maintain a long-term ownership stake in STF.

STF also announces that on November 8, 2024, it signed a contract with Gas Transmission Operator Gaz-System SA for the construction of the DN 1000 Gustorzyn-Wicko gas pipeline, specifically the Gardeja-Kolnik section. The contract is valued at 288.1 mpln gross and includes the construction of an approximately 88 km long gas pipeline with related infrastructure. The construction, to be completed within 25 months from the start date of November 7, 2024, is part of the FSRU program for establishing a floating LNG terminal in the Gdansk area. The project is expected to increase STF’s revenues in the gas transmission infrastructure segment, managed by the company's unit in Zabrze.

Stalprodukt – Declined performance for 3Q24 vs 3Q23

STP │ New Report │ P/TB 0.36 │ Steel Processing│ URL

The board of STP announces that the group's results for Q3 2024 show significant deviations from the average for the same period over the past two years, exceeding a material threshold of +/- 25%. During the quarter, STP reported a consolidated operating loss of -6.1 mpln, compared to an average operating profit of 60.3 mpln for Q3 2022 and 2023. Net profit amounted to -5.8 mpln, compared to an average of 49.2 mpln over the last two years.

Revenue from the sheet metal segment totaled 222.0 mpln, a clear decrease from the average of 397.1 mpln, while revenue from the profiles segment declined to 135.9 mpln from a previous average of 184.9 mpln. The results reflect a persistently challenging market situation, characterized by low demand, particularly in the profiles segment, and continued pressure on product prices.

The writer may own shares of the companies mentioned. This communication is for informational purposes only.